While we’re an avid proponent of disputing inaccurate charges on your credit report, there’s a right way and a wrong way to go about the process. Correcting inaccurate information as soon as possible is usually a sound approach, but sometimes it can backfire and make your credit score worse. Dovly handles the dispute process effectively and automatically, but if you’d like some more detail on how the dispute process works, keep reading. Let’s talk about chargebacks. A chargeback is the term for asking a credit card company to reverse your payment. The federal Fair Credit Billing Act gives you the right to request chargebacks under certain required conditions, but credit card charges should not be disputed without a legally sound reason. If you’re thinking about disputing a charge, make sure it checks off one of these boxes:

- Someone used your card without permission

- There was a billing error

- You’ve tried to resolve the error with the seller

If it doesn’t, you’re at risk of committing what’s known as “friendly fraud.” And if you haven’t already guessed it, committing friendly fraud is illegal, even if it’s for a low dollar amount. Dovly does not recommend disputing charges unless they are in fact, false. But let’s say you look at your credit report and notice multiple charges you certainly don’t recognize. You know you’ve been in California for the last three months, so why are you seeing a $45 charge from a store in Texas, a $120 Uber charge from Florida and a $250 charge from New York? When you notice multiple erroneous charges on your report, this is where it becomes critical to take a strategic approach to disputing the claims. The reason why you don’t want to dispute all inaccurate charges at once is because disputing too many at a time will get your charges flagged as “frivolous” by the bureaus. The frivolous status is rooted in the past—lazy credit repair companies used to send several dispute letters hoping one would be successful. They paid no mind to whether the disputes were valid or not, they just hoped something would stick. So of course, the best strategy is to not get flagged as frivolous, but it’s not the end of the world if that happens. If you ever find that a charge has been flagged as frivolous, credit bureaus must give you five business days to explain why. They also need to give you the information necessary to change frivolous disputes into legitimate ones. You can also write a short note explaining that frivolous charge for your credit report. Reports can take a while to update, so having a quick note on file can help lenders better understand your situation.

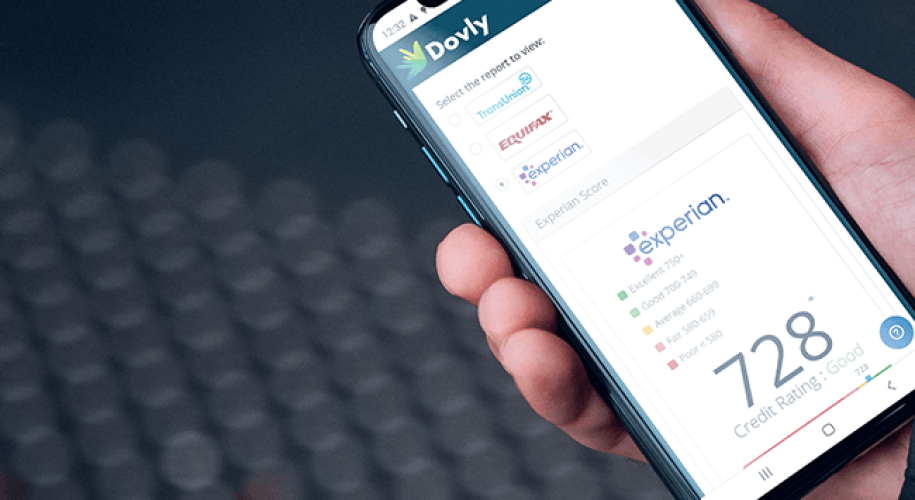

If all of this still seems overwhelming, Dovly can dispute the charges for you in a way that won’t get you flagged. Unlike ineffective and costly credit repair companies, Dovly is an affordable, effective, and efficient solution that can strategically dispute your charges. In fact, we’ve helped customers increase their score by 54 points on average within four months. Dovly is fully automated, so there’s no need to worry about handling anything on your credit report. Just leave it to us—we’ll take care of it. Interested in learning more? Contact us today to discover how we can help put you on a path to financial success.