Go Beyond Free Credit Repair Online With Dovly

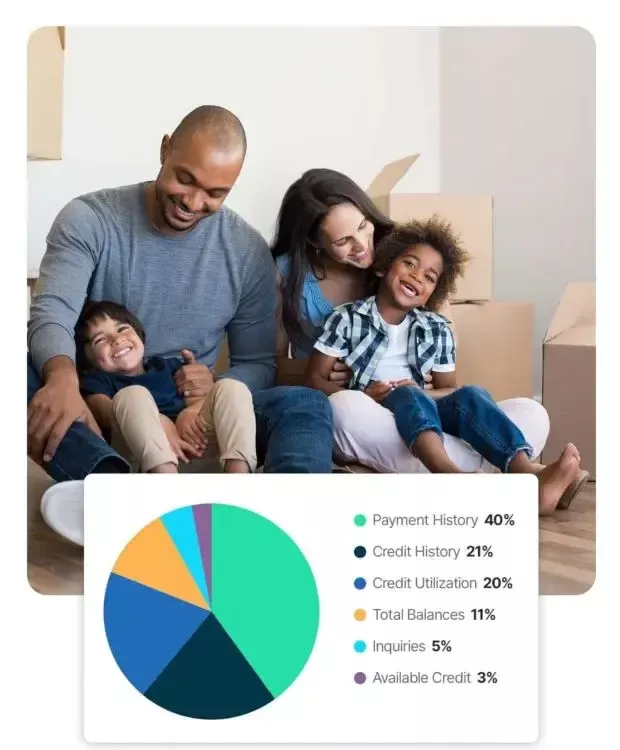

Dovly offers much more than free credit repair online. Dovly is a comprehensive AI credit solutions engine that monitors, (re)builds, and protects your credit – resulting in an average 82 points1 score increase. Dovly uses proprietary AI to offer a range of tools and services to assist you in achieving better financial health.

Bad Credit is Holding You Back

Ever felt stuck because of bad credit? Your credit score is more than just a number; it can be a significant roadblock, impacting various aspects of your life. From limiting access to credit and increasing interest rates to making it harder to secure housing, employment, and essential services, bad credit can cast a shadow over your aspirations. The strain it puts on finances may lead to stress and strained relationships, and its consequences can have a lasting impact on your ability to plan for the future.

Getting a Credit Card

Bad credit can also slam the door on getting a credit card. A credit card company, wary of your credit history, might reject your application or offer one with sky-high interest rates and minimal perks.

Getting a New Car

Bad credit can put the brakes on your plans to get a new car. Lenders, cautious about your credit history, may make it challenging to secure an auto loan. Even if approval happens, expect higher interest rates that drive up the overall cost of the car.

Purchasing a Home

Bad credit can crush your dream of owning a home. It makes getting a mortgage tough, with higher interest rates and hefty down payment demands. Lenders might even slam the door shut.

Qualifying For a Loan

Bad credit can stand in the way of qualifying for a loan. Lenders, skeptical of your credit track record, might make it difficult to secure the financing you need. Even if approval comes through, brace yourself for higher interest rates, increasing the burden of repayment.

70% of Credit Reports Contain Mistakes

Source: National Association of State PIRGs, 2004.

Without proper oversight by a credit repair company, your score might fall below its potential. Negative items like input errors, identity mix-ups, and delayed reporting contribute to a maze of discrepancies in the complex financial terrain. With extensive information exchange among creditors and credit reporting bureaus, the risk of inaccuracies in payment history and false account details becomes a significant concern.

Common Credit Issues & Their Impact

Late payments

Late payments on credit accounts can result in negative marks on your report. The more recent and frequent the late payments, the more significant the negative impact on your score. Not paying your bills on time can affect your ability to qualify for new credit and may result in higher interest rates.

High Credit Card Balances

Maxing out credit cards or carrying high balances on credit cards relative to your credit limit, known as a high credit utilization ratio, can negatively impact your score. It may signal financial strain and impact your ability to qualify for additional credit.

Collections

Accounts sent to collections due to non-payment can have a severe impact on your score. These entries remain on your report for several years, making it challenging to qualify for new credit.

Bankruptcy

Filing for bankruptcy is a major credit event that can stay on your report for seven to ten years. It significantly lowers your score and makes it difficult to qualify for new credit during that period.

Identity Theft

If you become a victim of identity theft, fraudulent accounts or transactions may appear on your report. Resolving these issues can be time-consuming and may temporarily impact your score.

Inaccuracies on Credit Reports

Errors on your credit report, such as incorrect account information or payment history, can lead to inaccurate credit scores. Regularly monitoring your report helps identify and dispute any inaccuracies.

Closing Old Accounts

Closing old credit accounts can impact the average age of your credit history, potentially lowering your score. It’s generally advisable to keep older accounts open to maintain a positive credit history.

Multiple Credit Applications (Hard Inquiries)

Applying for multiple lines of credit within a short period can result in multiple hard inquiries on your report. While each inquiry may have a minor impact, numerous inquiries can signal financial stress and lower your score.

How to Recognize Mistakes on Your Credit Report

Review Personal Information

Check for inaccuracies in your personal information, such as your name, address, Social Security number, and employment details. Ensure that all information is current and correctly reported.

Examine Account Information

Scrutinize each account listed on your report. Look for any accounts that you don’t recognize or that have inaccurate details, such as the account status, balance, or payment history.

Check for Duplicate Entries

Verify that each account is reported only once. Duplicate entries may artificially inflate your outstanding credit balances and affect your credit utilization ratio.

Review Payment History

Examine the payment history for each account. Ensure that late payments, if any, are accurately reported. Pay attention to the dates and frequency of any late payments.

Look for Closed Accounts

Closed accounts should be reported accurately, indicating whether they were closed by you or the creditor. If an account is listed as open when it’s closed, or vice versa, it could be an error.

Review Hard Inquiries

Verify that all hard inquiries listed on your report are legitimate and were authorized by you. Multiple inquiries within a short period may negatively impact your credit score.

Verify Credit Limits

Check the credit limits reported for your credit cards. Incorrect credit limits can impact your credit utilization ratio, potentially affecting your score.

Identify Accounts in Collections

If any accounts are reported as being in collections, verify the accuracy of this information. Ensure that any debts in collections are legitimate and appropriately reported.

Examine Public Records

Check for any inaccuracies in public records, such as bankruptcies, foreclosures, or judgments. These entries can have a significant impact on your score.

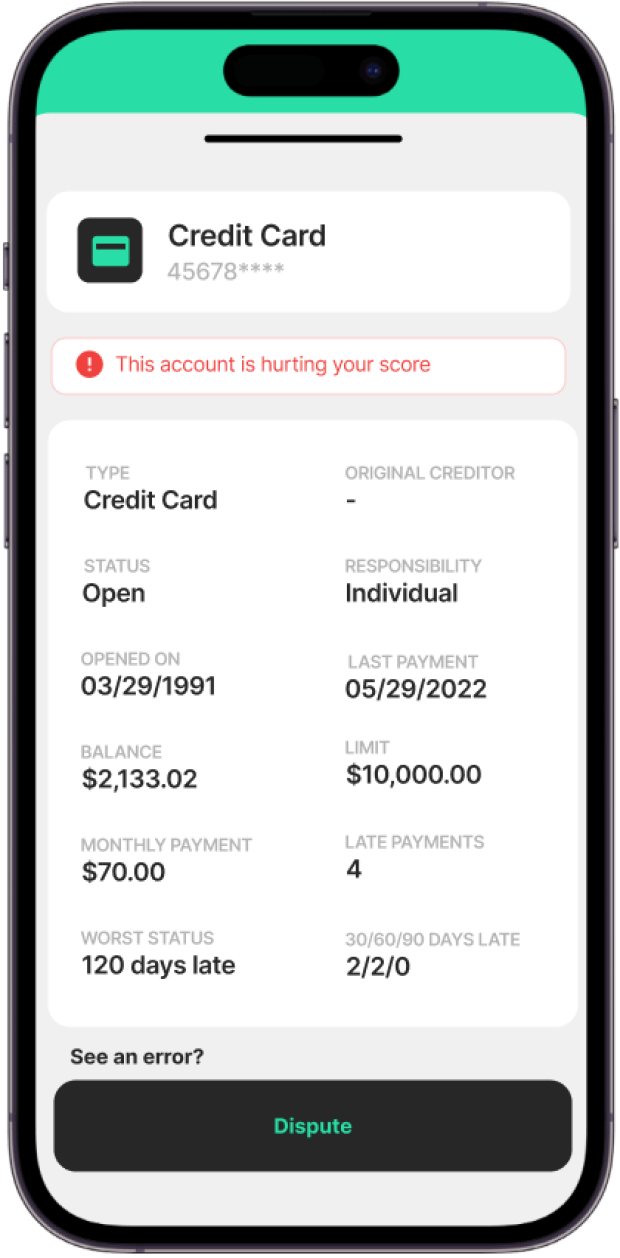

Understanding the Dispute Process

No need to hire credit counselors or search for credit repair services! With Dovly, you can sit back and relax as our AI engine starts working to remove inaccurate negative items from your credit reports: collections, charge-offs, late payments, and more. We’ll do a soft pull of your credit, that doesn’t harm your credit. We show you the items harming your credit so you can confirm what you’d like us to dispute with the credit bureau. As we work with them to remove inaccurate negative items, you’ll see your score increase.

Beyond Online Free Credit Repair

Dovly is a comprehensive credit solutions engine that monitors, (re)builds, and protects your credit. It offers a range of tools and services to assist you in achieving better financial health. Our mission is to help all Americans get ahead financially and empower them to reach their goals. Will you let us help you?

We’ve helped our members raise their scores by 5,000,000+ points4

Identify & Fix Credit Issues for Free with Dovly

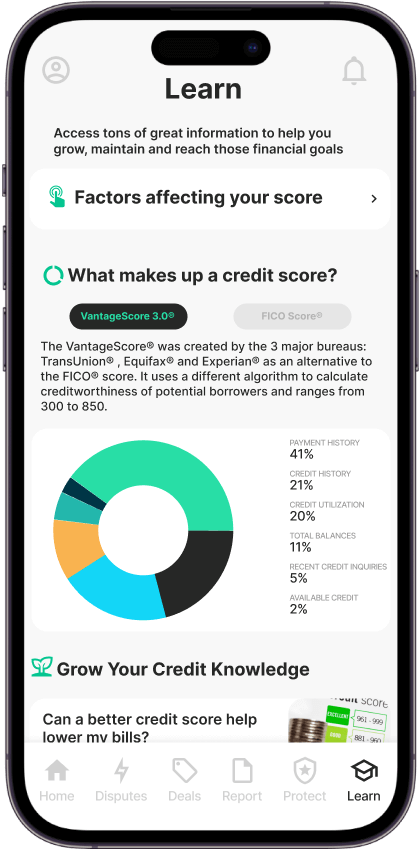

Dovly is not a traditional credit repair company. Dovly’s AI engine manages, disputes, fixes, (re)builds, and maintains your credit for you. It also provides personalized recommendations to boost your score and be your pocket financial assistant for life.

Access Your Credit Reports

Once you sign up for Dovly, you’ll get access to your credit report from the 3 major credit bureaus.

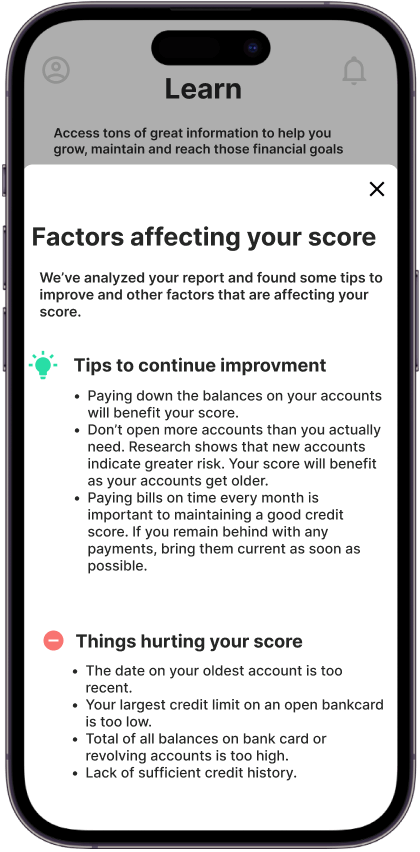

Identify Errors & Select Your Disputes

The first step to repairing your credit is to identify the negative items on your credit report.

Let Us Do the Heavy Lifting for You

Dovly will dispute them for you for free without you having to get on the phone or check in.

Benefits of Using Dovly

Dovly is not a traditional credit repair company. Dovly’s engine manages, disputes, fixes, (re)builds, and maintains your credit for you. It also provides personalized recommendations to boost your score and be your pocket financial assistant for life.

How do we compare?

Smart Error Resolution

We go beyond credit monitoring. What good is knowing your credit if you don’t know how to improve it? Dovly tracks, manages, and improves your credit.

Free Credit Solutions

Dovly offers the first, free automated credit improvement solution in the industry. We show you the items dragging down your score, you tell us which of those you want to dispute, and we take it from there. All you have to do is sit back and watch your score increase.

Free

Still unsure? Read more about how Dovly compares to the top credit improvement companies.

Real people. Real progress. Real awesome.

– Alexx

– Timothy

– Allen

Frequently Asked Questions

Is Dovly really free?

Dovly stays free for as long as you want! It is the first free credit care solution for individuals looking to get on a path to better credit. No hidden fees, no setup fees, no catches.

Dovly’s free plan provides a monthly TransUnion credit report and score, as well as manual dispute selection with TransUnion only. No credit card required. We also offer a Premium subscription with additional benefits such as our Smart AI engine proven to optimize score improvement, enhanced daily credit monitoring, unlimited AI-powered disputes with all 3 bureaus, weekly TransUnion credit report and score, and many more features for those looking for more extensive credit care.

Can I really do everything online?

Absolutely! That’s the whole point. With Dovly, fixing your credit is as easy as swiping. When you log into Dovly, we show you what’s hurting your score, and you swipe to confirm what’s accurate or not. And that’s when the magic happens. Our smart engine will prioritize the negative items and send them to the credit bureau so things get fixed as soon as possible. No printout, no mail, no phone call. No hassle.

Does repairing my credit with Dovly actually work?

Within six months, Dovly Free members see an average score improvement of 31 points*, while Premium members see a 79-point score improvement on average**. Our data shows that members who are more engaged and log into Dovly regularly see significantly better results. with over 20,000 reviews (5-star rating!), we know what it takes to make your credit right. Read our reviews.

*Average increase experienced by a sample of 21,118 Dovly AI Free members that have been enrolled more than 6 months, as of September 2023. ** Average increase experienced by a sample of 18,831 Dovly Premium members that have been enrolled more than 6 months, as of September 2023.

How long does it take to get results?

The timeline for credit improvement varies depending on your individual credit history and negative items on your report. Credit is a marathon, not a sprint. Most Dovly members see double-digit score increases within four months or less, but every situation is different.

Within six months, Dovly Free members see an average score improvement of 31 points, while Premium members see a 79-point score improvement on average*. Our data shows that members who are more engaged and log into Dovly regularly see significantly better results.

*Average increase experienced by a sample of 21,118 Dovly Free members that have been enrolled more than 6 months, as of September 2023. Average increase experienced by a sample of 18,831 Dovly Premium members that have been enrolled more than 6 months, as of September 2023.