Revolutionizing Credit: Dovly AI – The Smarter Alternative to AI Credit Repair

Millions of Americans don’t realize they have errors on their credit reports until they’re denied a loan or credit card 😩. But simply fixing mistakes won’t get you where you need to be. That’s where Dovly AI comes in—a smarter, AI-powered credit super app that helps you take control of your financial future.

Dovly AI isn’t about disputing errors—it’s a complete credit solution that analyzes your credit report, provides a personalized action plan, and helps you strengthen and protect your credit profile. Whether you’re recovering from financial challenges or optimizing your score for better opportunities, Dovly AI puts you in the driver’s seat.

AI Credit Repair? You Need More Than That.

A Smarter Approach to Credit

Dovly AI takes a proactive approach to credit health. Our advanced AI technology evaluates your credit standing and delivers personalized recommendations to help you grow and safeguard your score.

Save Time and Money While Building Strong Credit

Many services focus only on error disputes, leaving the bigger picture untouched. Dovly AI provides a holistic solution that helps improve your credit profile, protect against identity theft, and give you the tools to make smarter financial decisions—all without expensive fees.

A Credit Strategy That Works for You

Good credit isn’t just about removing negative items. Dovly AI continuously monitors your credit, offers data-driven insights, and equips you with strategies to improve and maintain a strong score.

Stay Ahead of Industry Changes

Credit rules and scoring algorithms are always evolving, but with Dovly AI, you don’t have to keep up alone. Our technology ensures you always have the latest tools and insights to maintain a strong credit profile.

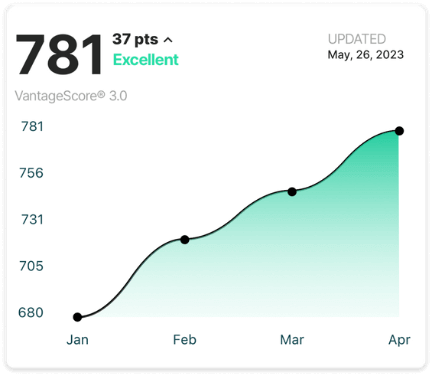

We’ve helped our members raise their scores by 9,000,000+ points4

Let AI Handle the Heavy Lifting

Managing your credit can feel overwhelming, but Dovly AI makes it simple. While traditional credit services focus narrowly on disputes, we provide a smarter, more comprehensive approach to financial wellness.

With Dovly AI, you don’t just fix—you build, protect, and grow your credit over time. Our AI-driven platform ensures that every action you take is strategic and effective, helping you unlock better financial opportunities.

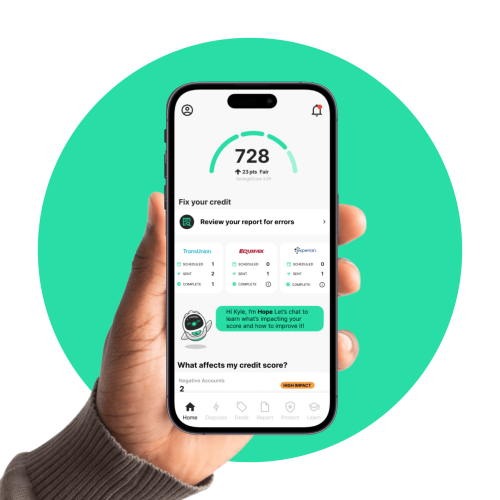

How Dovly AI works

Dovly AI is designed to take the guesswork out of credit management. Instead of juggling multiple services, you get everything you need in one seamless platform.

Step 1: Connect Your Credit Report

Dovly AI scans your report for factors affecting your score and creates a tailored strategy to improve your credit health.

Step 2: Take Strategic Action

Dovly AI equips you with personalized strategies to strengthen and safeguard your credit over time, while also identifying opportunities to improve your credit profile and ensuring inaccuracies don’t hold you back.

Step 3: Continuous Credit Improvement

Dovly AI isn’t a one-time fix—it’s an ongoing credit companion. Our system offers continuous monitoring, personalized insights, and tools to help you make informed financial decisions.

Step 4: Track Your Progress

See real-time updates on your credit improvements, new opportunities to strengthen your profile, and protective measures to keep your score secure.

What You Can Achieve with Dovly AI

Get approved for credit cards

No more denials based on outdated information.

Plan for major life milestones

Don’t let credit hold you back.

Buy a house or apartment

Lenders value a strong, stable credit score.

Save thousands on interest

A better score means better rates.

Purchase a car

Secure lower interest rates and better loan terms.

Achieve financial independence

Take control of your credit and your future.

Real people. Real progress. Real awesome.

– Paisley G.

I absolutely love this app. It does everything. I am so happy to be living in the age of AI

– Brett B.

– Hannah T.

AI Credit Repair & Credit Growth – FAQ

What is AI credit repair?

AI credit repair refers to the use of artificial intelligence to streamline credit dispute processes and improve credit profiles. However, true credit health requires more than just disputing errors—it takes a strategic, long-term approach, which is exactly what Dovly AI provides.

How can AI help improve credit?

AI-powered platforms can analyze credit reports, identify areas for improvement, automate disputes when needed, and provide insights to build a stronger credit profile. Dovly AI goes beyond standard AI credit repair by offering a complete set of tools for improving, maintaining, and protecting your credit.

How do I use AI to boost my credit score?

Dovly AI provides an easy-to-follow, data-driven approach to strengthening your credit. Our platform identifies improvement opportunities, helps you build credit from scratch, offers personalized recommendations, and automates key steps to help you achieve better financial health.

Is AI-driven credit improvement safe?

Dovly AI is built with security in mind, using bank-level encryption to protect your data. We never sell your information and prioritize compliance with privacy laws to ensure your personal and financial details remain secure.

How much does Dovly AI cost?

For $39.99/month, Dovly AI Premium members see an average credit score improvement of 82 points.* Plus, you can start for free and upgrade anytime. No commitments, no surprises.

What is the best AI-powered credit solution?

Dovly AI isn’t an AI credit repair solution—it’s a full-scale credit engine designed to help you repair, build, and protect your credit. With over 40,000 five-star reviews, we’re proud to be a trusted choice for anyone looking to improve their credit.

Your Credit Journey, Simplified

Credit health is about more than fixing past mistakes—it’s about building a stable financial future. Dovly AI gives you the tools, insights, and automation to make smarter decisions and take control of your credit with confidence.

✅ AI-driven precision

✅ Personalized strategies

✅ Continuous protection

Don’t settle for just credit repair. Take charge of your financial future with Dovly AI—the ultimate credit super app.