Identity fraud is a crime in which someone uses your personal information without permission. A thief may use your identifying information to make fraudulent transactions against your bank accounts, or he may steal your identity in order to take out loans or credit cards in your name.Since identity fraud and identity theft are so common, it’s important to recognize if there’s inaccurate information on your credit report. Your good credit is an important tool for obtaining a mortgage, auto loan, or credit card, and potential employers sometimes do a credit check as part of the screening process.

How Can You Tell if You Have Been a Victim of Identity Fraud?

If you’re a victim of identity fraud, it can impact your life for a long time. The sooner you recognize that something’s wrong and take steps to correct it, the better your chance of preventing major damage.Signs that someone is using your personal information include:

- There are unauthorized transactions in your bank account.

- You apply for credit and are denied even though you’ve always had good credit.

- You receive bills or credit card statements for purchases that weren’t made by you or for credit cards you didn’t open.

- You get calls from bill collectors for accounts you don’t recognize.

- You receive notification that you were denied credit for unknown inquiries.

- Your bank has an address you don’t recognize attached to your bank account.

Identity fraud can happen to anyone, and it does happen to millions of people each year. Closely watching your credit report and your bank accounts are important steps to take to protect your identity and prevent potential fraud.

Preventing Identity Fraud

Identity theft and identity fraud are easier to prevent than to address after they’ve already happened. While there’s no fool-proof way of preventing these crimes, there are some steps you can take to protect yourself. These include:

- Whenever possible, avoid carrying identifying information with you such as your social security card, medical identification cards, credit cards, or passports.

- Shred all documents with private information such as credit card statements and bank statements.

- Don’t use public WiFi for accessing bank accounts or paying bills.

Your bank may offer email or text alerts for activity on your accounts. These alerts can make you aware if changes are made to your accounts, such as address changes or issuing new credit cards or debit cards.

What to do if You Think You’ve Been a Victim of Fraud

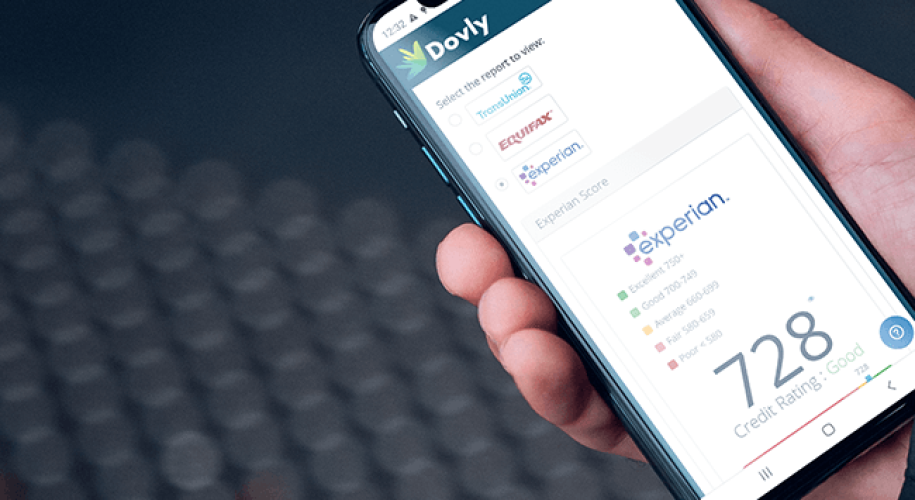

If you notice that your credit cards or debit cards are missing, notify your bank or creditor immediately. If you believe your identity may have been compromised, let your bank know as soon as possible. There are also important steps you should take to fix your credit after identity theft. With Dovly, you always have access to your credit score, and we can help you take the steps needed if you have concerns about identity fraud or if you need credit repair. Our credit monitoring service can alert you of changes to your credit report such as the opening of new accounts in your name. Reach out to Dovly support today to see how we can help you protect or rebuild your credit.