Table of contents

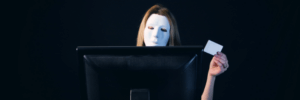

Imagine waking up to a nightmare, not in your bed, but in your financial world—your identity stolen and credit ruined. Identity theft is an invasive crime, shredding the financial security and peace of mind of its victims.

Navigating the aftermath of identity theft can feel like a labyrinth of credit scores and reports, phone calls and endless paperwork. It is a complex process that every victim must undertake to reclaim financial stability.

As we delve into the process of fixing your credit after Identity Theft, we will dissect each step necessary—from documenting the theft to communicating with financial institutions and devising a tailored recovery strategy. This article is not just a guide; it is the map that will lead you back to financial health and personal empowerment.

The Impact of Identity Theft

Identity theft can gravely damage your credit score and report, leading to unexpected consequences. When identity thieves gain access to your social security number, they may open new lines of credit or accrue debts under your name. Ultimately, when your social security is stolen, your credit report usually suffers. Suddenly, you might find your credit tarnished by fraudulent charges, collection accounts, late payments, and unwarranted balances that you’re not responsible for.

This fraudulent activity causes your credit utilization ratio to balloon, which is detrimental to your credit scores. Negative payment history, another outcome of identity theft, also significantly hinders your creditworthiness.

Want to learn the basics of identity theft, what it is, and how you can prevent it? We’ve got you covered!

What to Do If You’re a Victim of Identity Theft

When confronted with identity theft, swift action is essential. Start by securing a copy of your report from each of the three major credit bureaus: Equifax, Experian, and TransUnion. Look for any abnormalities that might spell fraud. Moving quickly, contact the bureaus to signal the presence of suspected fraudulent activity. A documented record of the incident is imperative, so filing a police report is a key step in the process. Engage with collection agencies and banks to address and eliminate fraudulent accounts and unauthorized late payments from your records. Remember, card companies often offer added protections against such events and may have policies in place to shield victims from the ramifications of unauthorized charges.

Step 1: Obtain a Copy of Your Credit Report

If you suspect that you have been a victim of Identity Theft, it is imperative that you obtain copies of your reports. Annually, you’re entitled to a free report from Equifax, Experian, and TransUnion. Under circumstances of suspected identity fraud, you can request additional free copies. Thoroughly inspect these reports for any foreign accounts, loans, or inquiries that you don’t recognize, as these are telltale signs of identity theft.

Step 2: File a Police and FTC Report

Once you have identified any suspicious activity or fraudulent accounts on your report, the next step is to take immediate action by filing a police report and notifying the Federal Trade Commission (FTC). These actions create an official record of the incident and help establish your case in resolving the identity theft.

Contact your local police department and provide them with all the necessary documentation, including any evidence you may have, such as copies of fraudulent card statements or emails related to the identity theft. The police report will serve as an important piece of evidence when dealing with creditors and financial institutions.

In addition to filing a police report, it is crucial to contact the FTC and submit a complaint through their Identity Theft Reporting website. This allows the FTC to gather information about your case and provide you with resources and guidance on the necessary steps to take. They can also assist in issuing an Identity Theft Report, which can help you dispute fraudulent accounts and transactions with creditors, credit bureaus, and debt collectors.

Step 3: Contact the Credit Bureaus

Reaching out to one of the credit bureaus – Experian, Equifax, or TransUnion – is a crucial step. Here’s a quick glance at the recommended steps to take with the Credit Bureaus:

Action | Purpose |

|---|---|

Fraud Alert | Alerts creditors of your identity theft, minimizing further risk |

Credit Freeze | Locks your credit file, preventing new accounts from being opened |

Review Reports | Identifies any suspicious activity or inaccuracies |

Dispute Errors | Notifies credit bureaus of fraud to remove unauthorized charges |

Inform them to enact a fraud alert on your credit reports. These alerts, lasting for 90 days, will prompt creditors to thoroughly verify your identity before approving any new credit or loans. It may be essential to place a credit freeze on your credit reports if you do not plan to apply for credit yourself in the near future. A credit freeze will not allow lenders to access your reports and prevent new accounts from being opened. This acts as a barrier to scammers attempting to misuse your information. Initiate these through any of the bureaus to protect your credit.

Hopefully, you have already reviewed your credit report in detail and have identified any suspicious activity or inaccuracies. If you haven’t, you will want to do that now. If you have identified any errors, you can dispute these errors with the credit bureaus.

Step 4: Notify Your Credit Card Companies and Financial Institutions

Take action by alerting your credit companies and financial institutions of the identity theft and fraudulent charges. Start by canceling all compromised cards to avoid liability for fraudulent transactions. Subsequently, request a replacement for each card where fraud was reported. In the United States, most major credit card providers maintain specialized fraud departments to deal with such concerns. A quick call using the number on the back of your card will connect you with the right department to register the scam and begin the recovery process.

How to Fix the Damage Done

Recovering from identity theft can be challenging, but taking immediate action can help fix the damage done to your credit. First, dispute any fraudulent charges with credit bureaus and lenders by contacting their fraud department. It’s essential to enforce your rights under the Fair Credit Reporting Act, which supports your recovery after identity theft.

Consider seeking advice from legal experts who specialize in identity theft issues. They can offer guidance on how to mitigate the harm to your credit history. Additionally, compile an Identity Theft Report at IdentityTheft.gov. This report will serve as a key document in rectifying issues with your bills and credit files.

To dispute any fraudulent accounts or errors on your credit, follow these steps:

- Obtain your report from Equifax, Experian, and TransUnion

- Analyze the report for inaccuracies or fraudulent hard inquiries

- Use a credit repair company to dispute any errors

- If necessary, inform any debt collectors that you’re an identity theft victim to resolve fraudulent debt in your name.

- Monitor your credit repair progress and score improvements

- If you disagree with the results of your final dispute, you can submit a complaint with the Consumer Financial Protection Bureau (CFPB)

Rebuild Your Credit

Rebuilding your credit after falling victim to identity theft can feel daunting, but by taking decisive and informed steps, you can restore your financial standings. Here are some things you can do in addition to fraud alerts and credit freezes.

Maintain persistent communication with credit bureaus, creditors, and any relevant parties until all fraudulent activities and their effects on your credit history are rectified. Diligence in monitoring your credit file is key to a full recovery.

It is crucial that you continue to pay your bills on time throughout this process to ensure you do not damage your credit further. Missing payments can not only cause your balances to enter the negative but may even cause negative item on your credit.

You may want to consider one or more of the following ways to build your credit if you have not already:

- Use a Credit Builder like CreditStrong or Kikoff

- Report rent payments through Boom or Self

- Get credit for existing bills using Cushion or ExperianBoost

Identity theft is a serious crime that can have long-lasting effects on your credit. By taking immediate action, being proactive in your approach, and staying vigilant, you can successfully fix your credit and regain control over your financial future. Remember, recovering from identity theft is a process, but with determination and the right steps, you can rebuild your credit and move forward.

We encourage you to enroll in a credit monitoring service to protect yourself moving forward. Dovly AI can assist you in monitoring, (re)building and protecting your credit. Enroll today for free to receive a monthly TransUnion report and score.

Frequently Asked Questions

Is Dovly Free Credit Repair?

No. We do much more than free credit repair. Dovly is a comprehensive AI credit solutions engine that monitors, (re)builds, and protects your credit. It offers a range of tools and services to assist you in achieving better financial health.

How is Dovly different?

Can I trust Dovly?

Yes, you can trust Dovly. Not only do we work with national banks, reputable businesses, and personal finance companies, we also have executive leaders who are accomplished and respected by industry peers. But more than anything our customers can attest to our value and service. Our Database is also encrypted and all personal information is stored on a segregated network to provide an additional layer of security.

How many points can I expect my score to go up?

Dovly Free members see an average score improvement of 37 points, while Premium members see a 69 point score improvement on average. Our data shows that members who are more engaged and log into Dovly regularly see significantly better results.