On track to improve your credit score, but not seeing results as quickly as you expected? Find out what may be slowing down the process or preventing your score from increasing (helpful tips included!)

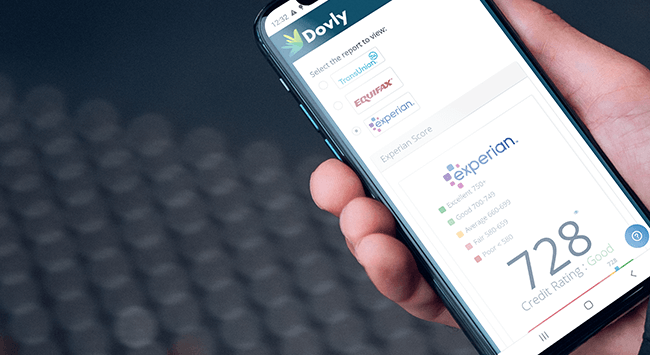

Dovly locates negative marks on your credit report and works to resolve them with the credit bureaus automatically. Our proprietary algorithm determines how to sequence and manage the disputes in a way that will get you the best results. The system communicates electronically with all three bureaus, who in turn communicate with credit data “furnishers” to correct errors. Furnishers include banks, lenders, credit card issuers, and collection agencies – essentially anyone that reports information to the bureaus. This process can take about 30-45 days per dispute, but there may be additional delays.

- Example 1: Even though your negative marks were resolved, other things may be hurting your score. Look out for new errors that may have been reported and remember which factors make up your score – payment history, credit utilization, length of credit, new inquiries, and credit mix.

- Example 2: Let’s say your credit card company reports to the bureaus on the 6th day of the month. Dovly disputes an inaccuracy on the account and the bureaus process the request on the 5th. The correction is overwritten because your credit card company did not respond quickly enough, even though the dispute was valid. It takes another month for the correction to hold.

- Example 3: Did you sign up for or hire more than one credit repair service? This may cause your account to be flagged and prevent the bureaus from relaying disputes to furnishers.

Some helpful tips from our experts:

- The lower your credit utilization is, the better! Experts say to keep utilization below 50%, although 10%-30% is ideal.

- Closing an account impacts your credit history and may result in a score decrease. Keep good accounts open and make timely payments to avoid negative marks or a score drop.

- Applying for new lines of credit (credit cards, loans, etc.) may decrease your score – remember that the number of inquiries you submit has an impact.

- Monitor progress in your Dovly dashboard or sign up for daily alerts about changes to your credit report. We also provide a monthly credit report update at no additional cost.

92% of Dovly customers see results in 6 months or less, many in just 30 days. It all depends on your situation and every case is slightly different. Our team is here for you, so don’t hesitate to reach out with questions or for additional tips. To better credit! The Dovly Team