Disputing credit report errors is an important step to take in building good credit.But that doesn’t mean it’s always an easy or straightforward step to take.Although credit report errors can be fairly common, disputing them is still a little-known option. It’s time to fix that.To help, here are a few terms you should know when disputing your credit report.

- AnnualCreditReport.com

The first term you should know is AnnualCreditReport.com — the website you can go to in order to receive your credit reports for free once per year. If you’re at the dispute stage with your credit report, you might already know this site. But if not, know that this is the place you can go to receive each of your three credit reports for free once a year.

- Credit Report

Again, if you’re at the dispute stage, you already know what a credit report is. So why is this term being included here? The answer is simple: many confuse credit reports with credit scores while others assume that these two items go together. They don’t. Although the information in credit reports populate the data needed to generate credit scores, they are two entirely different products.What’s more, you can’t dispute a credit score the way you can dispute a credit report. However, successfully disputing your credit report should have an impact on your credit scores.

- Credit Reporting Agency (CRA)

This is an important term to know when disputing your credit reports — especially since it can lead to an unsuccessful dispute if not fully understood. The credit reporting agencies generate our credit reports and there are three of them.The three CRAs are Equifax, Experian, and TransUnion. They are separate companies that create their own credit reports on you, which means that your three credit reports won’t necessarily be identical.Financial institutions like credit card companies get to choose whichever CRAs they want to work with and are by no means obligated to report your payments data to all three.That means that when it comes to disputing credit report errors, it’s important that you know which CRA’s credit report has an error — and then only dispute with that CRA.If you dispute an error on your Equifax credit report with Experian, for example, the dispute will be unsuccessful. One CRA won’t fix incorrect information on another CRA’s credit report.

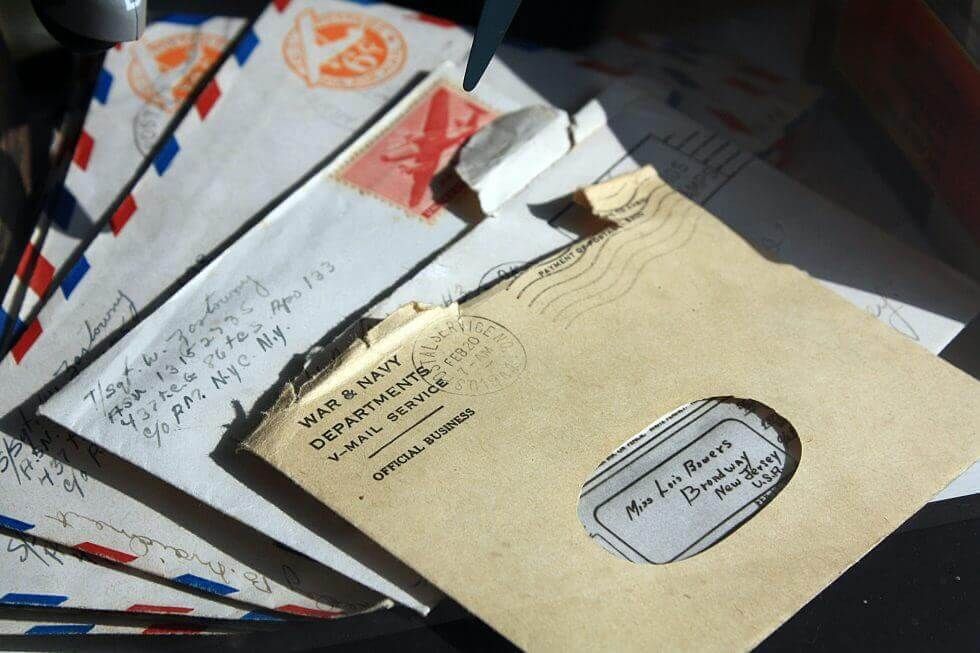

- Dispute Letter

Before it was so easy to do things online, a credit report dispute would start with a dispute letter sent by consumers to the CRA reporting incorrect information.This letter would explain what information is incorrect, how you want it to be resolved, and would include any documents to prove your case.Nowadays, it’s easier than ever to dispute a credit report online. You can do it on the websites of the CRAs.The only reason to go with snail mail and write a dispute letter instead might be because you love a paper trail. But if speed is what you want, it might make more sense to go ahead and file that dispute online.

- Frivolous Claims

There are times when a CRA can deem a credit report dispute to be “frivolous.” If that happens, the dispute is dismissed, and any changes you requested won’t happen. So, what’s a frivolous dispute? One way a dispute can be deemed frivolous is if the dispute lacks enough information to proceed with an investigation. Another is if the dispute is identical to a previously filed dispute. In other words, you can avoid a frivolous dispute by carefully filling out all the requested information when you file and avoiding filing the same exact dispute twice in the hopes of getting a better result. The idea of disputing your credit report might sound daunting, but the truth is the process can be relatively quick and painless. Once you finish filing your dispute, the CRA typically has 30 days to investigate. What that means is you could see a more accurate credit report and potential changes to your credit scores in a short period of time. By ensuring that your credit report is accurate, you’re taking a significant step towards building good credit and the credit opportunities that come with it. And working with a credit engine like Dovly can really help you build up your credit score. It will help you get your credit score, your summary, and a clear view of what you need to do to improve your credit. Want to find out more? Then CLICK HERE!