Your credit report is used to make lending decisions whenever you decide to apply for a mortgage, credit card, or loan. It affects whether you’ll be approved and whether you’ll receive the best interest rates.

Errors and inaccurate information that appear on your credit report can drive your credit score down. It’s extremely important to dispute any errors you find on your credit report as soon as you’ve learned about them. Common errors on your credit report may include problems such as:

- Accounts that haven’t been updated correctly

- Errors in your personal information

- Balances owed or credit limits are wrong

- Loans appear to be open that have been paid in full

- Loans appear to be past due that have always been paid on time

- Someone else’s information appears on your credit report

- Someone else has opened accounts in your name

You may also have problems triggered by a divorce, such as debts that belong to your ex-spouse appearing on your credit report. Understanding credit and what you need to do to improve what’s on your credit report shouldn’t be confusing or difficult. Dovly wants to help empower you to gain control of your finances.

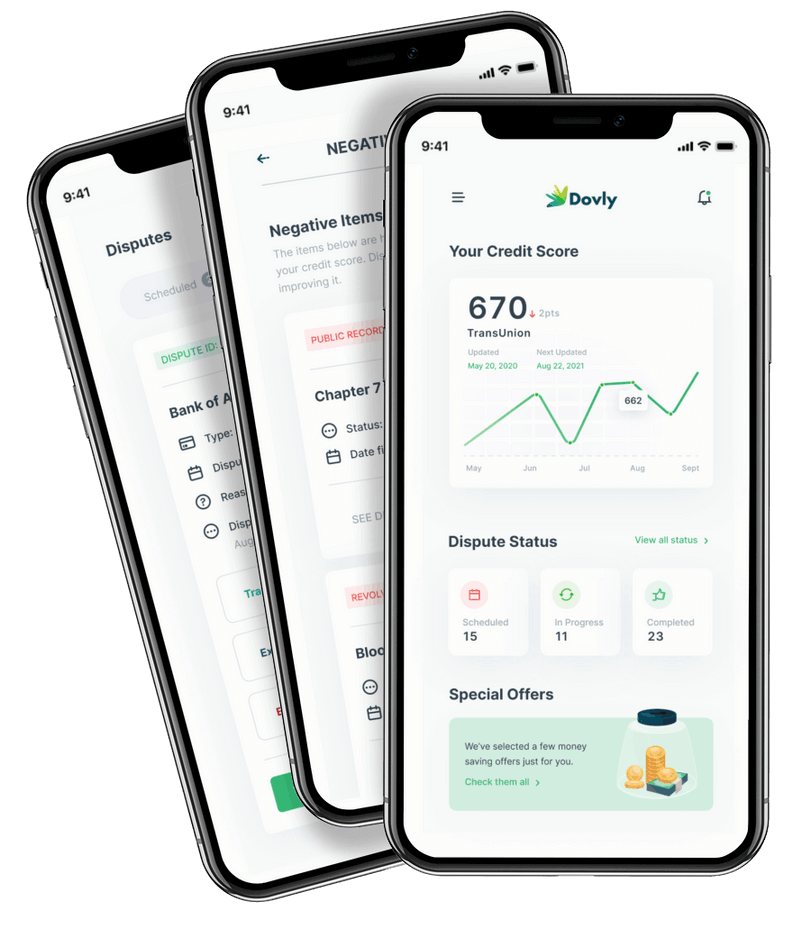

Simplify Credit Disputes with Dovly

Dovly is an advanced credit repair engine that disputes errors on your credit report for you, and one of the best credit repair softwares on the market. There’s no need for you to get on the phone with credit bureaus and be kept waiting on hold. Try it risk free with our free membership tier. We’ll do the heavy lifting for you. Here’s how it works:

- You’ll review your current credit report and identify any items that need to be disputed.

- Dovly gets right to work initiating credit disputes with the credit bureaus while you sit back and relax.

When we succeed in removing negative items from your credit report, you’ll be able to see an increase in your credit score which can help you obtain the credit you deserve. The process couldn’t be simpler.

Removing Negative Items

Negative items have the power to harm your finances for many years to come. If your credit report contains inaccurate information on any of the following, they need to be corrected immediately. Negative items may include:

- Late payments

- Collections

- Charge-offs

If you feel like you have no idea how to go about getting negative items removed, there’s no reason to worry anymore or to keep procrastinating about getting errors corrected. Dovly can find and fix errors promptly.

Enjoy Real Peace of Mind

You don’t need to worry about continually checking your credit score anymore. Dovly offers an automated AI service, which means checking your credit and any necessary credit help is done on autopilot. Dovly’s AI credit engine can get you a head-turning credit score with credit (re)building, monitoring, alerts, scores, tips, and tricks – all in one place. Try it risk-free with our free membership tier.