Disputed Information Was Verified As Accurate: What Now?

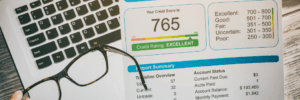

When a credit dispute is verified as accurate, it can feel frustrating, but understanding the next steps is essential for protecting your credit. This guide will walk you through what to do after receiving dispute results, from reviewing the findings and assessing their impact on your credit report to exploring further dispute options. Whether it’s verifying the accuracy of the information or considering legal action, these strategies will help you manage your credit health moving forward. Plus, regular credit monitoring will keep you informed and ready to respond to any changes in your credit profile.

Receiving the results of a credit dispute can be a pivotal moment in managing your credit profile. If the disputed information was verified as accurate, it means the major credit bureaus or credit reporting agencies—Equifax, Experian, and TransUnion—have confirmed that the details on your credit report are correct. Understanding what steps to take next is crucial for maintaining and improving your credit score. This comprehensive guide will help you navigate the process after your dispute results are returned, ensuring you address any issues effectively.

Review the Dispute Results Thoroughly

The first step after receiving your dispute results is to carefully review the findings. When the bureaus have verified that the disputed information was accurate, they provide a detailed summary explaining their decision.

Key Points to Check:

- Detailed Summary: Examine the explanation provided by the bureaus. This will outline why the disputed information was confirmed as accurate and what evidence was used in their decision-making process.

- Original Dispute: Compare the results with your original dispute letter and the specific errors you flagged. Ensure that the reasoning for verification aligns with the information you provided.

Actions to Take:

- Verify Accuracy: Cross-check the verified information against your records. Ensure there are no discrepancies between your records and the information verified by the bureaus.

- Note Any Conflicts: If you spot any inconsistencies or if the explanation provided doesn’t make sense, document these conflicts for further action.

Evaluate the Impact on Your Credit Report

When the disputed information is verified as accurate, it remains on your report and can impact your credit score. It’s important to understand how this information affects your overall credit profile.

Assessment Steps:

- Review Credit Score: Look at how the verified information has influenced your credit score. For instance, if the dispute involved late payments or high credit card balances, these factors can negatively affect your score due to payment history reported. You can view your score on any of the bureaus websites or directly through FICO.

- Check Report: Ensure that other details in your credit report are accurate and have not been inadvertently affected by the dispute process. Additional credit report errors could appear. You are entitled to one free report every 12 months through annualcreditreport.com

Considerations:

- Impact on Financial Products: Assess how the current state of your report affects your eligibility for credit cards, loans, or other financial products. This can help you plan your next financial moves accordingly.

- Long-Term Effects: Understand the potential long-term effects of the verified information on your credit history and take steps to mitigate any negative impacts.

Address Potential Misunderstandings

Sometimes, disputes are verified as accurate due to misunderstandings or incomplete information. If you believe that the credit bureaus might have misunderstood your dispute, take the following steps:

Clarification Steps:

- Contact Credit Bureaus: Reach out to the bureaus to seek clarification on their findings. Request a more detailed explanation if necessary.

- Provide Additional Documentation: If new or additional evidence has come to light, submit this documentation to the bureaus to support your case on the credit report errors.

What to Include:

- Detailed Explanation: Write a clear, concise explanation of why you believe there may be credit report errors. Include any new evidence or documentation that supports your claim.

- Supporting Documents: Attach any relevant documents such as bank statements, payment confirmations, or other evidence that could help clarify the issue.

Explore Other Dispute Options

If the disputed information remains verified as accurate but you still believe it should be corrected, consider additional dispute options:

Further Actions:

- File a New Dispute: If you have new information or evidence, file another dispute with the bureaus. Make sure to include all relevant details and documentation.

- Add a Statement of Dispute: If you cannot resolve the dispute through the usual process, add a statement to your report explaining your side of the issue. This statement will be visible to potential creditors who review your report.

Strategies:

- Detailed Documentation: Ensure that any new dispute includes a comprehensive explanation and supporting documents that address the specific issues raised in the previous dispute.

- Follow-Up: Monitor the outcome of the new dispute and follow up with the bureaus as needed.

Consider Seeking Legal Advice

If you’ve exhausted all other options and the disputed information remains verified as accurate, seeking legal advice may be a viable path forward:

Legal Considerations:

- Consult an Attorney: A lawyer specializing in credit issues can provide guidance on whether there are any further legal actions you can take. They can also help you understand your rights and options.

- Attorney Fees: Be aware of the potential costs involved in hiring an attorney. Assess whether the benefits of legal advice outweigh the costs.

Potential Outcomes:

- Legal Action: If necessary, your attorney can help you determine if pursuing legal action against the credit bureaus or creditors is warranted.

- Resolution Strategies: An attorney can also assist in negotiating with creditors or seeking alternative dispute resolution methods.

Review Your Financial Products and Credit History

After receiving the dispute results and understanding their impact, review your financial products and overall credit history:

Review Steps:

- Assess Financial Products: Check how the verified information affects your credit card limits, loan terms, and other financial products. This can help you make informed decisions about your finances.

- Adjust Financial Plans: Based on the current state of your report, adjust your financial plans and strategies to mitigate any negative effects.

Actionable Tips:

- Credit Utilization: Work on improving your credit utilization rate to positively impact your credit score.

- Timely Payments: Ensure that you make timely payments on all your accounts to maintain a positive credit history.

Monitor Your Credit Regularly

Maintaining regular oversight of your credit is essential for catching any future issues early:

Monitoring Tips:

- Obtain Regular Reports: Get copies of your credit report periodically from each of the major credit bureaus to monitor for changes and errors.

- Use Credit Monitoring Services: Enroll in credit monitoring services that alert you to any new or updated information on your credit.

Benefits:

- Early Detection: Regular monitoring helps you detect and address potential issues before they impact your credit score.

- Financial Awareness: Staying informed about your credit report supports better financial planning and decision-making.

Conclusion

When the disputed information was verified as accurate, it can be a challenging situation to navigate. By thoroughly reviewing the dispute results, evaluating the impact on your credit report, and considering additional actions such as seeking legal advice or filing further disputes, you can effectively manage your credit profile. Regular monitoring and strategic adjustments to your financial products and plans will help you maintain a healthy credit history and score. Taking these steps will position you to better manage your financial future and respond proactively to any credit issues that arise.

For ongoing support in managing your credit, consider enrolling with Dovly AI. Dovly provides advanced credit management tools that can help you continuously monitor your credit profile, streamline dispute processes, and improve your overall credit health. With Dovly’s AI-driven solutions, you can more effectively address credit report errors and maintain a strong credit score, giving you peace of mind and financial stability. Enroll today for free and receive your TransUnion credit report and score!

Frequently Asked Questions

Is Dovly Free Credit Repair?

How is Dovly different?

Can I trust Dovly?

How many points can I expect my score to go up?