How To Remove Negative Accounts From Your Credit Reports & Skyrocket Your Credit Score

Removing a negative account from your credit reports can really increase your credit score. Paid off closed accounts remain on your credit reports for seven or 10 years. However, if you want yours removed sooner, you could try one of our two recommended methods:

Method #1 – A Goodwill Letter. This is a letter you write to the creditor asking them to remove the negative information, such as a record of late payments. The assumption is that you have an otherwise positive history with them and can point to the negative items being isolated incidents. This might not be effective on closed accounts since the creditor wouldn’t likely be continuously reporting anything to the credit reporting companies. But depending on your situation, you may decide that it is worth it to try. Understand either way that the creditor is under no obligation to remove or stop reporting accurate information to the credit reporting companies. Some of the elements of a goodwill letter may include the following:

- A clear and friendly tone

- Details about why there were late payments or other negative items on your account

- Proof that you’ve had an otherwise positive history with that financial institution

- An explanation about why it’s important to you to have the data removed now

If you’re hoping to have a closed account you still owe on removed from your credit report, one option you may want to consider is our second recommended method.

Method #2: “Pay For Delete” Letter.This is a letter offering to settle the debt in exchange for the removal of it from credit reports.This can be trickier than a goodwill letter, however, since creditors aren’t required to stop reporting accurate information to credit reporting bureaus. Therefore, if you wouldn’t have otherwise settled the debt, then you could end up doing so without getting the results you wanted on your credit report. Some of the elements of a “pay for delete” letter may include the following:

- The desire to settle the debt, but not a promise to do so

- A caveat that you’re not agreeing that you owe the debt

- An offer to settle the debt for a certain amount in exchange for the creditor doing what they can to remove it from your credit reports

- A request for written proof that they will comply within a certain timeframe

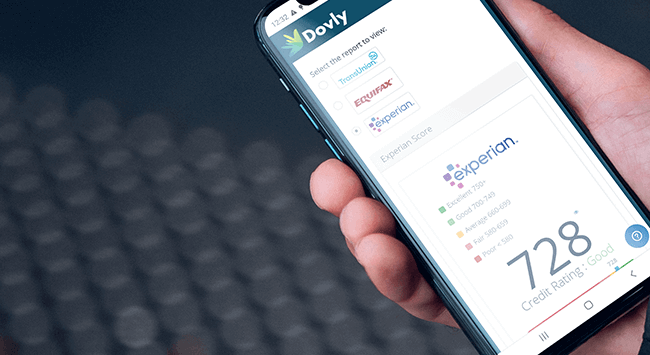

Managing and improving credit reports can be a hard process. That’s why you should give Dovly a try. We’ll help you easily review individual items on your TransUnion credit report securely online, get personalized recommendations and discover potential areas of improvement. As a result you’ll be able to improve your credit, get better loan terms and pay less interest. Sounds interesting? Then join us now at Dovly! Try it risk-free with our free membership tier.