How to Improve Credit Score From 500 to 700

A credit score of 500 can significantly hinder your financial opportunities, leading to loan denials, high interest rates, and limited housing and job prospects. However, improving your credit score is possible with consistent effort and smart strategies. This blog outlines actionable steps like reducing credit utilization, disputing errors, and using credit-builder loans to boost your score. It also highlights how Dovly’s technology automates credit disputes, monitors your progress, and provides personalized recommendations to help you achieve a higher score and unlock better financial opportunities.

A low credit score of 500 can feel like a constant roadblock on your journey to financial health and growth. From being denied loans and facing high interest rates to struggling with limited housing options and even employment challenges, the impact of a low credit score can be far-reaching. Unfortunately, with a score in this range, many people find themselves stuck in a cycle of financial difficulties. But the good news is that it doesn’t have to be permanent.

By understanding how your credit score is calculated and taking the right steps to improve it, you can gradually work your way toward a better financial future. Whether it’s paying off debt, disputing errors on your credit report, or utilizing tools like Dovly, there are multiple strategies to break free from the constraints of a low credit score. Let’s see how to increase to a good credit score.

Challenges You Face with a 500 Credit Score

A 500 credit score can bring many financial problems including:

- Loan Denials: Many lenders consider a 500 credit score too high risk and deny loans.

- High Interest Rates: Approved loans come with very high interest rates and long term debt.

- Limited Housing Options: Renting a home or apartment may require higher deposit or co-signer.

- Credit Card Denials: Approval for credit cards is limited to secured cards with upfront deposit.

- Employment Challenges: Some employers check credit history for financial responsibility and limit job opportunities.

- Higher Insurance Premiums: Poor credit means higher auto and home insurance premiums.

How Credit Scores Are Calculated

Your credit score is calculated using your credit report and is based on how responsibly you manage your financial life. Think of your credit score like a report card for your borrowing habits. Here’s a breakdown:

- Payment History (35%): This is like turning in homework on time. Paying bills (credit cards, loans, etc.) on time shows lenders you’re reliable. Missing payments is like skipping homework — it hurts your score.

- Credit Utilization (30%): Imagine having a credit limit as your financial allowance. Using too much of it makes you seem overextended. Keeping balances low (below 30% of your limit) shows you can handle credit wisely.

- Credit Age (15%): This is like loyalty points. The longer you’ve had credit accounts open, the better. Lenders trust people with proven track records.

- Credit Mix (10%): Think of this as showing versatility. Having a mix of credit types (credit cards, car loans, mortgages) suggests you can juggle different financial responsibilities.

- New Credit (10%): This is like being cautious with new commitments. Applying for a lot of new credit at once can make lenders wonder if you’re desperate for money. Spacing out applications helps.

Managing your credit well over time builds a strong credit report and credit score, helping you qualify for better financial opportunities!

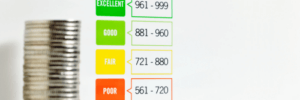

Credit Score Ranges

Understanding credit score ranges helps you see where you stand and what goals to set:

- 300-579 (Poor): Major credit problems; hard to get approved.

- 580-669 (Fair): Subprime range; limited credit options with higher rates.

- 670-739 (Good): Good terms and approval probability.

- 740-799 (Very Good): Competitive rates and better offers.

- 800-850 (Excellent): Top rates and premium credit products.

Why a 700 Credit Score Matters

A credit score of 700 or higher unlocks significant financial benefits:

- Lower Interest Rates: Enjoy reduced rates on loans and credit cards.

- Loan Approval Odds: Qualify for mortgages, car loans, and personal loans more easily.

- Better Credit Card Rewards: Access premium credit card benefits.

- Improved Financial Security: Higher scores reduce financial stress through better terms.

Common Credit Score Myths Debunked

“Checking your credit score lowers it.”

Only hard inquiries affect your credit score, while soft inquiries, like checking your score yourself, don’t.

“Closing old accounts helps.”

Closing accounts can negatively impact your credit score by shortening your credit history and increasing your credit utilization.

“Only people with debt have credit scores.”

Even responsible credit use, such as using and paying off a credit card monthly, builds your credit score.

“You need to carry a balance to build credit.”

Paying off balances in full every month still helps build credit.

“Once negative items are on your report, they can’t be removed.” You can dispute inaccuracies or negotiate with creditors to remove negative entries.

Actionable Tips for Improving your Score

Improving your credit score from 500 to 700 is achievable with consistent effort and good financial habits. Here’s a step-by-step guide:

1. Pay Down Credit Card Balances (ASAP)

Why it works: Lowering your credit card debt improves your credit score fast.

How to do it:

- Snowball Method: Pay off the smallest balance on credit accounts first, then roll payments to the next one.

- Avalanche Method: Pay off the highest-interest debt first for long-term savings.

- Tip: Make extra payments after each paycheck.

2. Set Up Payment Reminders or Autopay

Why it works: Payment history makes up 35% of your credit score.

How to do it:

- Use calendar reminders.

- Set up autopay through your bank or creditors for minimum payments to avoid late fees.

- Tip: Double-check payment due dates to align with your pay schedule.

3. Dispute Credit Report Errors

Why it works: Correcting errors on credit accounts can give a credit score boost.

How to do it:

- Check Reports: Visit annualcreditreport.com to get free credit reports for all three credit bureaus.

- Review: Look for incorrect balances, missed payments, or unfamiliar accounts.

- Dispute: File disputes online with the major credit bureaus – Experian, Equifax, and TransUnion.

- Tip: Use certified mail for serious disputes to create a paper trail.

4. Negotiate Old Debts

Why it works: Clearing collections helps remove negative marks on your credit history.

How to do it:

- Call Creditors: Ask for a “pay for delete” (they remove negative entries if you pay).

- Negotiate Settlements: Offer 50-75% of the balance.

- Tip: Get all agreements in writing before paying.

5. Get a Secured Credit Card

Why it works: It builds positive credit history with low risk and helps diversify credit mix. OpenSky is a great option.

How to do it:

- Research secured credit card with low annual fees.

- Deposit funds (usually $200-$500) to open the account.

- Use the card monthly, but keep balances under 10% of your limit.

- Pay the full balance each month to avoid interest charges.

6. Become an Authorized User

Why it works: You benefit from someone else’s good credit.

How to do it:

- Ask a trusted family member with excellent credit.

- Ensure they never miss payments and have a low credit card balances.

- Use the card responsibly if granted access, but you don’t need to use it to benefit from their history.

7. Request a Credit Limit Increase

Why it works: A higher credit limit reduces your credit utilization ratio.

How to do it:

- Call or Apply Online: Use the bank’s mobile app or website.

- Reasons to Request: State your on-time history and income increase if applicable.

8. Use a Credit-Builder Loan

Why it works: It creates a positive history while building savings and helps diversify credit mix. Credit Strong is a great option.

How to do it:

- Find a Lender: Credit unions and online lenders like Self offer these loans.

- Make Monthly Payments: Payments go into a savings account until the loan is fully paid.

- Withdraw Funds: After repayment, access the money while your on-time payments boost your score.

9. Avoid Opening New Credit Accounts

Why it works: Fewer credit inquiries keep your credit score stable.

How to do it:

- Avoid applying for multiple loans or credit cards in a short time.

- Use tools like pre-qualification checks (soft inquiries) before applying.

- Tip: If you must apply, space out applications by 6 months or more.

10. Pay Every Two Weeks Instead of Monthly

Why it works: Reduces credit utilization faster and improves your payment history.

How to do it:

- Split Monthly Payments: Pay on your credit card balances every two weeks instead of once a month.

- Apply Extra Payments: Use any extra funds (e.g., bonuses) toward your card balances.

- Tip: Contact your card issuer to verify how they apply multiple payments.

How Dovly Can Help

Dovly can help increase your credit score by automating the credit improvement process through its proprietary technology. Here’s how Dovly works to boost your score:

- Credit Monitoring: Dovly tracks your credit profile, keeping you informed of changes that could affect your score. This allows you to address potential issues early.

- Credit Disputes: Dovly automates the credit dispute process by highlighting negatives on your credit report and submitting disputes on your behalf to TransUnion.

- Credit Score Tracking: You can monitor your credit score progress through Dovly’s platform, receiving updates on improvements as disputes are resolved.

- Tailored Recommendations: Dovly provides personalized tips on how to maintain a healthy credit profile and continue improving your score.

- No Hard Inquiries: Dovly’s credit checks won’t hurt your score, allowing you to monitor your credit risk-free.

By using Dovly’s smart technology, you can take control of your credit and work toward a higher score with minimal effort.

Conclusion

Improving your credit score from a 500 to the good credit score range may seem like a challenging task, but with dedication and the right tools, it’s entirely possible. By focusing on key strategies such as reducing credit utilization, making on-time payments, and disputing errors, you can start to see real improvements.

One of the best ways to streamline the process is by using Dovly’s smart technology. Dovly automates the credit dispute process, helps you track your credit score progress, and provides personalized recommendations tailored to your financial situation. With Dovly on your side, you can take control of your credit and make steady progress toward a brighter financial future. Start today, and let Dovly help guide you on the path to a higher score and better financial opportunities.

Frequently Asked Questions