How to Improve 565 Credit Score

Hey there, friend! If you’re dealing with a credit score of 565, don’t worry—we’ve got your back. Your credit score might be a little lower than you’d like right now, but the good news is that there are plenty of steps you can take to improve it. In this blog post, we’ll share some friendly and practical tips to help you boost your credit score and pave the way to a brighter financial future. Let’s dive in!

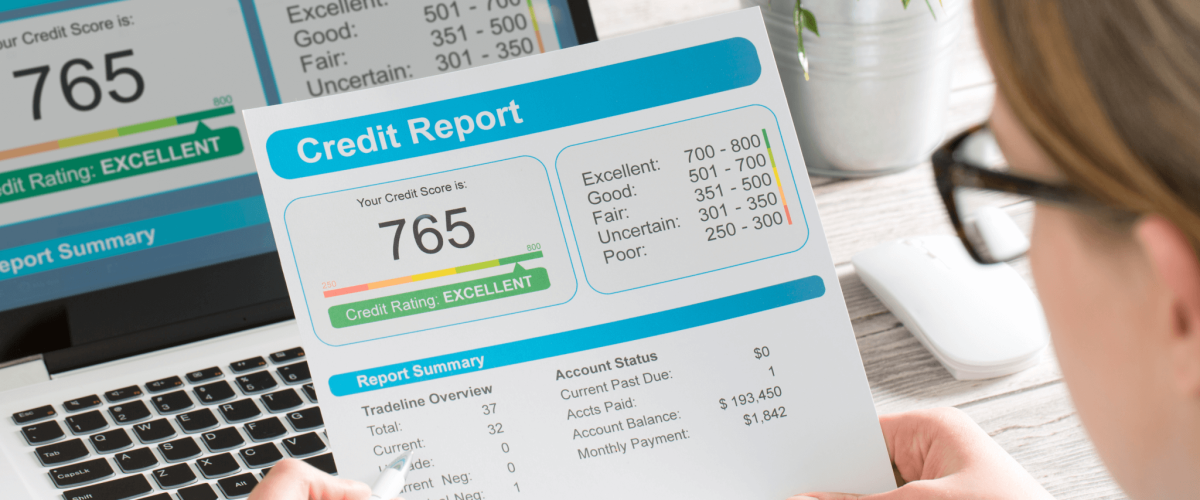

Face Your Credit Report:

The first step to improving your credit score is to know where you stand. You can do this by checking your credit report. This will show you your credit history and give you an idea of what’s dragging your score down. Dovly is a free AI credit engine that can help you dispute any errors you find on your credit report. Try it risk-free with our free membership tier. Get in touch with Dovly today.

Pay on Time, Every Time:

Consistently paying your bills on time is vital for credit score improvement. Set up reminders or automatic payments to ensure you never miss a due date. Paying your bills promptly will gradually demonstrate your financial responsibility and help rebuild trust with lenders.

Tackle Outstanding Debt:

Reducing your outstanding debt can have a significant impact on your credit score. Create a budget to manage your finances effectively and allocate extra funds towards paying off your debts. Consider the snowball or avalanche method to tackle your debts strategically.

Communicate with Creditors:

If you’re struggling to make payments, don’t hide from your creditors. Reach out to them and explain your situation. Many creditors are willing to work with you to create a payment plan or negotiate better terms. Proactive communication shows your commitment to resolving your debts.

Build Positive Credit History:

To counterbalance past credit issues, start building a positive credit history. Consider applying for a secured credit card, enrolling in a credit builder program, or becoming an authorized user on someone else’s credit card. Make small, regular purchases and pay them off in full each month. Over time, this responsible credit behavior will enhance your score.

Keep Credit Utilization Low:

Credit utilization, or the percentage of available credit you’re using, plays a significant role in your credit score. Aim to keep your utilization below 30% by paying down balances or requesting a credit limit increase. Be mindful of your spending and avoid maxing out your credit cards.

Be Patient and Persistent:

Improving your credit score won’t happen overnight, so it’s essential to be patient and persistent. Consistently practice good credit habits, stay committed to your financial goals, and celebrate small victories along the way. Your efforts will pay off in the long run.

There you have it, my friend! Your journey from a 565 credit score to a stellar credit standing begins with these practical tips. Face your credit report, pay on time, tackle outstanding debt, communicate with creditors, build positive credit history, keep credit utilization low, and be patient and persistent throughout the process.

Remember, improving your credit score is a marathon, not a sprint. With determination and discipline, you can rebuild your creditworthiness and unlock new financial opportunities. Trust in yourself, take action today, and watch your credit score soar to new heights. You’ve got this!