Table of contents

Have you ever wondered how a past eviction could shadow your future housing opportunities? Understanding the duration an eviction stays on your record is crucial for renters and landlords alike. Evictions don’t just remove tenants from properties; they leave a mark that can haunt one’s rental history for years.

In this article, we navigate through murky waters of rental histories, credit implications, and strategies for rebounding from an eviction. We’ll also provide insights on how to sidestep this significant setback altogether, laying a foundation for a more secure tenancy.

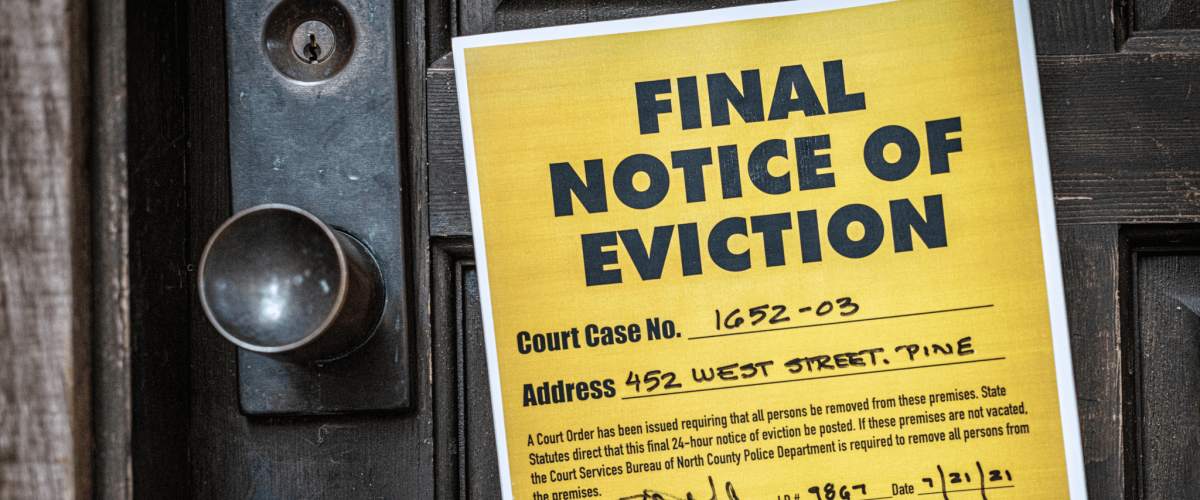

The Eviction Process

The eviction process typically begins with a notice from the landlord, such as a 7-day notice for nonpayment of rent payments or a 14-day notice for lease violations. If unresolved, the landlord may file an eviction lawsuit. A negative outcome for the tenant results in a legally binding eviction judgment, which is then documented in both the tenant’s rental history reports and public court records.

Impact of Evictions

Credit Report and Score

While the eviction itself may not be directly listed with the credit reporting agencies, the financial consequences often do. If unpaid rent from an eviction is handed over to a collection company, this debt becomes a blemish on your report. Debts in collections have a negative effect, dragging down your credit score.

Evictions are also known as unlawful detainers. They go to court and when there’s a judgment placed, that becomes a public record. As of 2017, judgments are no longer reported on your credit profile as a result of a settlement agreement. However, due to judgements being public records, lenders can view and use these types of situations when determining approval and eligibility.

Rental History or Tenant Screening Reports

Landlords frequently access tenant screening reports when evaluating rental applications, and eviction records are almost invariably included. Therefore, a past eviction will likely surface during these checks, influencing a landlord’s decision.

How Long is an Eviction on Your Record

An eviction will stay on your record for at least seven years, and up to ten years, depending on the statute of limitations in your state. This means that the eviction will show up on your credit report and rental reports for whichever is longer, seven years or your state’s statute of limitations.

How to Have an Eviction Removed From Your Record

Having an eviction on your record can be a distressing thing, whether you are trying to rent a new place or not. However, you may have options to remove an eviction from your record. Follow these steps:

- Challenge the Eviction in Court: If you believe the eviction is unjust, file a petition to have your case heard. Winning the case may result in the removal of the eviction from your record.

- Negotiate with the Property Manager: Communicate with your previous landlord. Discuss the circumstances of your eviction and inquire if they can request the eviction’s removal from rental reports.

Removal from Rental History

- Make amends with your previous landlord by paying any back rent and fees associated with getting the apartment ready for a new tenant. Get any payment agreements in writing to prevent your landlord from selling your debt to a collection agency if they haven’t already.

- Request a copy of your tenant report from a tenant screening company. Privacyrights.org provides a list of companies that prepare such reports for landlords, but because there are so many different groups generating reports, it’s wise to ask your landlord which company they use and then request that specific report.

- Review your tenant report for any inaccuracies related to the eviction. If you find any errors, dispute them with the screening agency to have them corrected or removed.

For more information on disputing errors on your Tenant Background Check, read this article from the Federal Trade Commission.

Disputing with the Credit Bureaus

To remove rent collections from your credit report, you can follow these steps:

- Contact the collection company: Reach out to the collection agency that is reporting the rent collection. You can negotiate a pay-for-delete agreement where you pay the debt in exchange for them removing the collection from your credit report.

- Dispute the collection: If the rent collection is inaccurate or incomplete, you can dispute it with the credit bureaus. They will investigate the claim and remove it if they find it to be invalid. A removal of a collection can positively affect your credit score and overall credit history.

An eviction on your record doesn’t spell the end of your financial future. Discover more tips on how to remove evictions from your record!

Can You Rent With an Eviction on Your Record?

Renting with an eviction on your record can be challenging, but it’s not impossible. Being forthcoming with prospective landlords about your past can work in your favor. Consider presenting a higher deposit as a sign of commitment. Explaining the context of your eviction and demonstrating current financial stability can ease potential concerns. Repairing relations with your past landlord can also be beneficial. This might result in a more favorable reference when approaching new landlords. Being proactive can mitigate the hurdles you may face when dealing with past evictions. Gather references from reliable sources, maintain transparency about the eviction, and curate a renter resume showcasing your responsibility. These steps can enhance your credibility and might persuade landlords to consider your application favorably.

How to Avoid Eviction

To avoid eviction, it’s crucial to maintain open communication with your property manager and address any issues promptly. If you face financial difficulties, consider seeking assistance from organizations like the Community Renewal Team or the Salvation Army, which can offer support to prevent eviction.

Here’s what you can do to avoid eviction:

- Create a budget and ensure rental payments are your top priority.

- Promptly communicate any concerns with your property manager.

- Seek financial help from aid organizations to cover unpaid rent.

- Protect yourself from unexpected financial hardships by setting aside money for emergency situations.

While all of these options can help you avoid eviction, it is best to set yourself up for financial success regardless of your situation. The best thing you can do to set yourself up for financial success is to monitor, maintain and build your credit. Dovly is an advanced credit engine, focused on assisting people with overall credit improvement and financial wellness. Enroll today for free and receive a monthly TransUnion report and score.

Frequently Asked Questions

Is Dovly Free Credit Repair?

No. We do much more than free credit repair. Dovly is a comprehensive AI credit solutions engine that monitors, (re)builds, and protects your credit. It offers a range of tools and services to assist you in achieving better financial health.

How is Dovly different?

Can I trust Dovly?

Yes, you can trust Dovly. Not only do we work with national banks, reputable businesses, and personal finance companies, we also have executive leaders who are accomplished and respected by industry peers. But more than anything our customers can attest to our value and service. Our Database is also encrypted and all personal information is stored on a segregated network to provide an additional layer of security.

How many points can I expect my score to go up?

Dovly Free members see an average score improvement of 37 points, while Premium members see a 69 point score improvement on average. Our data shows that members who are more engaged and log into Dovly regularly see significantly better results.