675 Credit Score: What It Means and How to Improve It

Got a 675 credit score and wondering what it really means? You’re not alone. In this guide, we’ll break down how credit scores work, what a 675 score unlocks (think: credit cards, auto loans, and more), and the smartest moves you can make to boost your score even higher.

You know that feeling, right? Like your credit score is this mysterious thing that suddenly dictates whether you can get that new car or even rent that cool apartment. If you’ve ever stared at your credit score wondering what it means and how it affects your future, trust me, you’re definitely not the only one scratching your head.

If you’ve found yourself with a credit score of 675, you’re likely curious about what that means, what it unlocks, and how you can make it even better. Let’s break down a 675 credit score together.

What is a credit score?

It’s a three-digit number that potential lenders use to quickly judge how likely you are to pay back borrowed money. Think of it as a financial grade based on your credit history.

The bureaus (Equifax, Experian, and TransUnion) gather information about your credit habits, and scoring models like the FICO score analyze this data to predict your future financial risk.

What Makes Up Your Credit Score?

Think of your credit score like a recipe. It’s a three-digit number made up of different financial ingredients, and each one has a specific weight. Here’s the ingredients that calculate credit scores:

Payment History (35%): This is the big kahuna! It looks at whether you pay your bills on time, every single time. Late payments can really bring your credit down, so being punctual is key.

Amounts Owed (30%): This examines your credit utilization rate which is the total amount of credit you’re using compared to your total credit limit. It’s often referred to as your credit utilization ratio or your credit utilization rate. Ideally, you want to keep this number low.

Length of Credit History (15%): The longer you’ve been using credit responsibly, the better it looks. This factor considers the credit age of your oldest and newest accounts, as well as the average age of all your accounts.

Credit Mix (10%): Lenders like to see that you can handle different types of credit, such as installment loans (like car loans or mortgages) and revolving credit (like credit cards). Having a healthy mix can give your credit score a little boost.

New Credit (10%): Opening many new credit accounts in a short period can slightly lower your credit score. Each time you apply for credit, it can trigger a “hard inquiry,” which can impact credit scores.

Knowing what goes into your credit score is like understanding the ingredients in that recipe we talked about. Once you see how things like paying bills on time and managing your debts actually matter, it starts to make more sense how your money habits matter.

Is a 675 Credit Score Good?

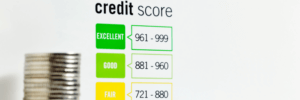

Now, let’s compare your 675 credit score to the credit score ranges. Credit scoring models, like FICO Score and VantageScore, typically range from 300 to 850.

Think of the credit score ranges like levels in a game, and you’re aiming for the highest score possible! Here’s a general idea of what those levels look like:

Exceptional Credit (800+): This is like hitting the jackpot! You’re in the VIP club and will likely get the best deals and terms out there.

Very Good Credit (740-799): You’re rocking it! You’re in fantastic shape and will have access to some sweet deals and favorable terms.

Good Credit (670-739): This is where your 675 credit score falls! It’s considered a good FICO score, and you’ll generally be approved for most loans and credit cards, though perhaps not always with the absolute best rates.

Fair Credit (580-669): This is like being in the middle of the pack. You might still get to play the game (get credit), but you might face some handicaps, like higher rates or fewer choices.

Poor Credit (Below 580): It can be tough to get approved for credit at all, and if you do, the terms are probably not going to be very friendly.

Based on recent data, the average credit score is a good credit score sitting at 715 using the FICO scoring model. It is important to note that there are different credit scoring models that lenders can use such as the VantageScore. A 675 is still considered a “good” credit score whether it’s a FICO Score or a VantageScore.

There are also multiple different FICO scores available as FICO provides scores to specific types of lending. There is a FICO score for car loans and even FICO scores for home loans.

Available Lending Options

Having a “good” credit score like 675 puts you in a strong position to access various credit products and services like a loan or credit card, opportunities that weren’t available when you were in the fair range.

Here’s a closer look at what opportunities typically become available to you now that you’ve surpassed a fair credit score:

Securing Solid Credit Card Options:

With a good credit score, you’ll likely be able to get regular, unsecured credit cards, not just the ones where you have to put down a deposit. This means you could even snag cards with cool perks like cashback or travel rewards.

Now, you might not get the super fancy, top-of-the-line cards with the absolute lowest interest and best benefits right away (those usually want to see even higher scores), but you’ll definitely have access to more than fair credit. You’ve unlocked decent credit limits and reasonable interest rates.

Achieving Affordable Auto Loans:

Dreaming of a new car or needing a reliable vehicle? With a 675 credit score, getting approved for an auto loan is generally quite achievable. You’ll likely qualify for decent interest rates, meaning you’ll pay less in interest over the life of the loan compared to someone with a fair credit score or poor credit score.

While the lowest rates might be reserved for those with higher credit scores, you’ll still be in a good position for manageable monthly payments on your new car loan.

Exploring the Path to Homeownership:

Homeownership is a significant goal for many, and a good credit score can definitely put you on that path. You’ll likely be eligible for a home loan, allowing you to purchase a home.

It’s worth noting that your interest rate might be slightly higher compared to someone in the “very good” or “exceptional” credit score range, which is why exploring options and potentially putting down a larger down payment can be beneficial in securing more favorable terms.

Accessing Personal Loans:

Stuff happens, right? Unexpected bills pop up, or maybe you’ve got a home project you’re itching to tackle. That’s where personal loans can come in handy. With a 675 credit score, you’re usually in a good position to get approved for one.

Whether you’re thinking about simplifying your debts with a single payment or finally getting started on those renovations, lenders will likely see you as a solid candidate. Keep in mind that the exact interest rates and how long you have to pay it back can vary depending on who you borrow from and your overall financial picture, but having that 675 score means those options are generally available to you.

Higher Scores Mean Better Opportunities

While a 675 is a good credit score, striving for improvement can unlock even more favorable financial opportunities down the road. Think of it as moving from a good spot to an even better one!

Here are some areas where a higher credit score could make a difference:

Lower Interest Rates: Even a small improvement in your credit score can translate to significantly lower interest rates on loans and credit cards over time, saving you money on interest payments.

Better Credit Card Perks: Access to premium credit cards with richer rewards, lower annual fees, and more attractive benefits often requires a higher credit score.

Increased Approval Odds: While you’ll likely get approved for most things with a 675, a higher credit score can further solidify your approval odds, especially for larger loans like mortgages.

Higher Credit Limits: As your credit score improves, lenders may be more willing to offer you higher credit limits, providing you with more financial flexibility (though it’s crucial to use credit responsibly).

Steps to Improve Your 675 Credit Score

Ready to take your 675 credit score to the next level? Here are some actionable strategies you can implement:

- Pay Your Bills On Time, Every Time: This cannot be stressed enough! Set up automatic payments or reminders to ensure you never miss a due date. Even one late or missed payment can have a negative impact on your payment history.

- Reduce Your Credit Utilization Ratio: Aim to use only a small portion of your available credit. Experts often recommend keeping your credit utilization below 30%, and ideally even lower. If you have multiple cards you owe on, consider paying down the highest credit card balances first.

- Don’t Close Old, Unused Credit Card Accounts: As long as they don’t have high annual fees, keeping older, unused credit cards open can actually help your credit score by increasing your overall available credit and boosting your credit history length.

- Monitor Your Credit Report Regularly: Obtain free copies of your credit reports from all three major credit bureaus. Review them for any errors or inaccuracies such as incorrect late payments or even unknown accounts and hard inquiries. Dispute any errors you find.

- Be Cautious About Opening Credit Accounts: While a healthy credit mix is good, avoid opening multiple new accounts in a short period, as this can temporarily lower your credit score due to hard inquiries. The goal is to have longer credit history so opening new accounts can also impact the average length of credit history.

- Consider Becoming an Authorized User: If a trusted friend or family member with excellent credit is willing to add you as an authorized user to one of their credit card accounts, their positive credit history could potentially help boost your credit score.

- Explore Credit Builder Loans: If you have limited credit history or are looking to build credit, these tools can help you establish a positive track record. Credit builder loans allow you to make payments towards a loan that is held like a savings account.

Let’s be real – boosting your credit score isn’t like flipping a switch. While doing the right things, like making on-time payments without fail, will help, bigger improvements take time. Especially if you’re trying to fix past credit hiccups, it can take several months, maybe even longer, to really see a difference.

Stay consistent with your efforts and build good credit habits. Remember that building a strong credit score is a marathon, not a sprint. Hang in there and be patient – think of it as planting a seed; it takes time to grow!

Once you’ve improved your credit, the work isn’t over. Maintaining good credit requires continuous responsible financial habits. Continue to pay your bills on time, keep your credit utilization low, and monitor your credit reports regularly. The goal is to stay above the fair credit range.

By staying vigilant, you can ensure your credit remains a valuable asset and can even stabilize your financial situation.

Conclusion

Understanding your credit score and taking steps to improve it is an investment in your financial well-being. A 675 credit score is a solid foundation, but by implementing these strategies, you can aim for even greater financial opportunities and security.

Navigating the world of credit can sometimes feel overwhelming, but you don’t have to do it alone. Dovly is dedicated to helping you understand and improve your credit, making your financial goals more attainable.

Enroll today and take a step towards a brighter financial future!

Frequently Asked Questions