Credit Improvement Made Easy with Dovly

Life happens. It keeps throwing financial curveballs at you, and sometimes your credit score takes a hit. But what if improving your score felt achievable and even…empowering? At Dovly, we believe everyone deserves financial freedom. Forget about the confusing credit jargon and let us break down the complexities of credit improvement into simple, actionable steps. Sign up for free, sit back, relax & watch your score improve on autopilot!

Millions of Americans Have Errors On Their Credit Reports

Millions of Americans don’t know they have harmful errors on their reports until they’re rejected for a credit card of a loan 🙁.

Based on studies from recent years, between 46-70% of all credit reports contain errors, which can bring down the credit score, but people don’t realize they have a right to dispute them! Any negative item that is inaccurate, unfair, or unverified can be challenged with the bureaus and your creditors. This includes collections, late payments, charge-offs, bankruptcies, repossessions, and more.

You Deserve Better Credit

Bad credit can feel like a dead end. High interest rates, limited loan options, housing struggles… a low credit score limits your options and creates unnecessary stress.

Credit card disapproval: forget about those bonus points and introductory offers! Bad credit can make it difficult to qualify for a credit card, and even if you do, you might be stuck with high interest rates and minimal rewards.

Unfavorable car loan terms: saving for a down payment is hard enough, but bad credit just makes buying a car a total headache! Even if you get approved, brace yourself for higher interest rates that substantially increase the car’s total price.

Limited mortgage options: bad credit history is a giant STOP sign on your dream of buying a house. Obtaining favorable mortgage terms, including interest rates and down payment requirements, may be difficult.

Expensive loans: lenders want to make sure you’re on solid financial ground, so they might dig a little deeper into your credit history. This can make it harder to get approved, and even if you do, the interest rates might be a bit higher.

But Improving Your score Isn’t Easy

Slow process: credit improvement takes time and effort, and hiring a reputable credit repair company to do it for you can make the credit repair process even slower.

High fees: credit repair companies typically charge a monthly fee after providing an initial consultation and can quickly become expensive.

Limited impact: a credit reporting agency can challenge errors or outdated entries on your credit reports, but they can’t guarantee results with a credit bureau.

Potential credit repair scams: legitimate credit repair companies do exist… but unfortunately, scammers do exist too! They often lure you in with promises of quick fixes or complete credit score deletion with the major credit bureaus, and may pressure you into signing contracts or paying for unnecessary credit repair services.

Meet Dovly: Credit Improvement on Autopilot

Unlike credit repair companies, we take the stress out of improving your credit & make it easy to take charge of your finances.

Not Your Average Credit Repair Company…

Dovly is your one-stop shop for everything credit. Credit monitoring, credit score analysis, credit profile management, credit building… you name it! Whatever your needs are, we’ve got your back with our additional services! We don’t only help you rebuild your credit, we’re also here to help you build and maintain it. Start free and find out how easy credit management can be. No setup fees, no catches!

Improve Your Credit Score While You Sleep

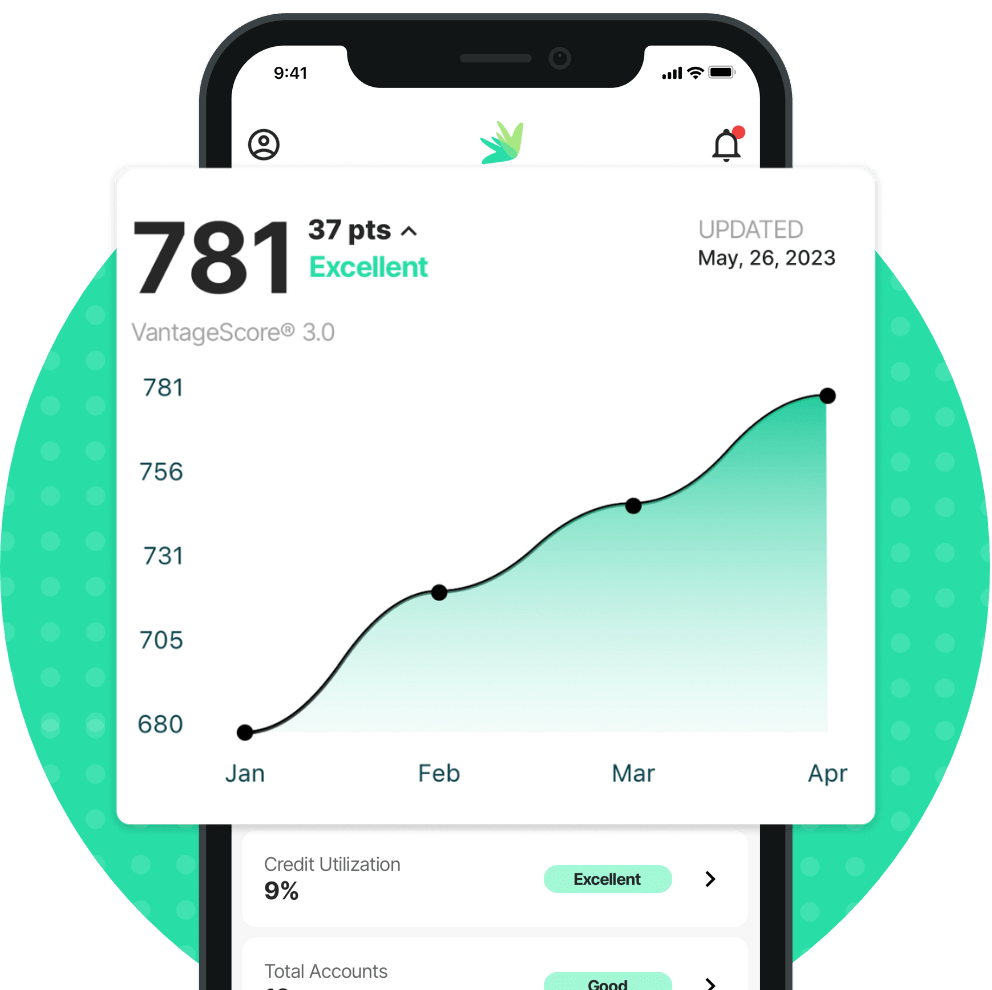

Forget juggling credit improvement companies, credit repair services and credit counselors, or going through an endless credit repair process! Dovly makes it easy for you to improve your credit situation. Our AI engine takes control, tackling inaccurate negative items on your credit reports. We’ll do a soft credit check (no harm done!) and show you exactly what’s dragging your score down. Then, you decide what we dispute on your behalf with the credit bureau. Watch your score climb as we work our magic!

Your Credit Improvement Questions Answered

Dovly distinguishes itself by its holistic approach to credit management. Unlike credit reporting agencies, we don’t just diagnose you with credit score analysis; we’re committed to addressing and resolving your credit issues. Dovly offers a comprehensive credit care platform, providing you with all the necessary tools to effectively manage your credit and improve your financial well-being, all within one user-friendly interface. No more juggling multiple solutions – Dovly is your all-in-one solution for credit monitoring & management.

Absolutely. You can do independent research on good credit practices. You can contact the credit bureaus and your creditors to get any questionable negative items removed from your credit reports. That said, Dovly provides personalized tips and tricks to boost your credit and keep it high. Dovly AI streamlines the dispute process and can often achieve faster results with our AI credit engine.

Dovly helps in a number of ways. In addition to analyzing your credit report and identifying negative items that may be impacting your score negatively, Dovly AI is an advanced credit engine that monitors, (re)builds, and protects your credit on an ongoing basis. It is fully automated, meaning we can help 24/7 without you having to contact us on business days. Our engine has a secret recipe for electronically submitting your disputes to credit bureaus, as well as providing personalized tips and tricks to increase your credit.

Within six months, Dovly AI Free members see an average score improvement of 34 points, while Premium members see a 82-point score improvement on average*. Our data shows that members who are more engaged and log into Dovly AI regularly see significantly better results.

No hidden fees. No setup fees. No catches.

AI-powered credit engine.

Smart, simple, and 100% free.