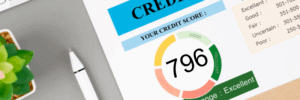

796 Credit Score: What It Means, What You Can Get, and How to Make It Even Better

A 796 credit score puts you just shy of the 800+ club—and that’s a great place to be. It means you’ve built strong credit habits, unlocked premium financial perks, and earned lenders’ trust. In this guide, we’ll explain what a 796 really means, what you can do with it, and how to maintain (or even improve) your score using smart, strategic credit moves.

If your credit score is 796, you’re in great shape—and that number has been earned with good credit behavior over the years. But just because you’re doing well doesn’t mean your work is done. A 796 score unlocks big financial perks but it also requires strategy to maintain—and even more finesse to get into the 800+ club.

In this post we’ll cover everything you need to know about a 796, what you can get and what you can do to stay ahead of the game.

What Does a 796 Credit Score Mean?

A 796 falls in the very good credit score range on the FICO score scale which goes from 300 to 850. You haven’t quite hit the excellent credit range (which starts at 800) but you’re knocking on the door. In fact a 796 is considered excellent credit under the VantageScore model.

Most lenders view consumers with this high of a score as extremely low risk borrowers which means you’re in a great position to get credit products with good terms, premium rewards credit cards and potentially save thousands over time in interest.

In short: a 796 credit score means you’ve built a solid credit report with smart financial moves. It reflects a pattern of on-time payments, low credit card balances, long standing credit accounts and limited inquiries. That’s no small feat—and it can pay off in more ways than one.

With the average credit score according to FICO scores at 718 and VantageScore at 702, your score puts you well above average. This means you have strong financial trustworthiness and you’re in one of the top credit tiers.

Also note that there’s not just one way to calculate credit scores. The two most common scoring models are FICO® credit scores and VantageScore®. Both use the same 300 to 850 scale and consider similar factors but weight each differently. That’s why we mentioned the two different average credit scores and why your score might vary slightly depending on where you check it.

What You Can Get With a 796 Credit Score

With a 796 FICO score, you’re in great shape to get almost any loan or credit card—with better interest rates, higher credit limits and premium perks.

Home Loans

Buying a home with a 796 credit score is almost always easier—and cheaper. With this score you’ll likely qualify for the best mortgage rates from top lenders. Lower interest rates means lower monthly payments and long term savings.

Auto Loans

Looking for a car? A 796 score positions you for low interest rate auto loans, potentially with zero down or flexible terms. Lenders will see you as someone who pays back what they borrow so approvals will be faster and less stressful.

Credit Cards

You’ll have your pick of premium credit cards, including those that offer:

- Generous cashback rewards

- High travel point multipliers

- Exclusive perks like lounge access and insurance benefits

- 0% APR offers and large sign-up bonuses

Your credit history tells lenders you can handle these perks responsibly and many financial institutions will compete for your business.

What Got You to a 796—and How to Keep It

A 796 is a very good credit score and it didn’t happen by accident. It reflects years of smart credit habits on your credit report. Here’s what likely helped you get there—and what to keep doing to maintain or improve it:

1. On-Time Payments

Payment history is the biggest factor in your credit score. If you’ve been paying credit cards, installment loans and other bills on time, you’ve built lender trust. One late payment on your credit report can set you back so use autopay or reminders to stay on schedule.

2. Low Credit Utilization Rate

Keeping your balances low—ideally below 10% of your credit limits—helps your credit score. Even if you pay in full large reported balances can hurt temporarily. Spread purchases across cards or pay early to keep utilization rate down.

3. Long Credit History

Older accounts help your credit score by showing long term credit management. Don’t close your oldest accounts—even if you rarely use them—to maintain a healthy average account age.

4. Diverse Credit Mix

Lenders like to see a mix of credit accounts such as revolving credit (credit cards) and installment loans (car loans, personal loans or a mortgage loan). There’s no need to open new accounts just for variety.

5. Fewer Hard Inquiries

Each application for new credit triggers a hard inquiry which can cause a small dip. Space out applications and only apply when necessary to keep your credit score stable.

Can You Improve from 796?

Yes—and it may be easier than you think. Getting from 796 to 800+ might only take a few months of focused effort. Here’s how to get into the excellent credit range:

- Review your credit reports with all three credit bureaus for errors or duplicate accounts, disputing if needed

- Pay down any existing credit card debt before they’re reported

- Set all accounts to autopay to prevent missed payments

- Avoid applying for new credit unless absolutely necessary

- Keep building positive payment history over time

Final Thoughts: Use Your Score, Don’t Just Sit on It

Having a 796 credit score is something to be proud of—but it’s not just about bragging rights. It’s a tool that can help you save money, get better offers and plan your financial future with confidence.

Don’t let your great credit sit unused—compare rates, shop smart and make sure you’re getting the benefits your credit score qualifies you for. And as always stay proactive about protecting your credit.

Want to Get to 800+? Let Dovly Help! Dovly is an AI-powered credit engine that helps you fix errors, monitor your credit report and even build credit—automatically. You can get a free credit score each month too!

Frequently Asked Questions

How common is 796 credit score?

Can I get a mortgage with a 796 credit score?

How good is 796 credit score?

How common is credit score over 800?