618 Credit Score: Approval Odds, Score Factors, and How to Improve It

A 618 credit score isn’t bad—but it’s not great either. It puts you in a transitional spot where you still have access to credit, but often with higher rates and added hurdles. The good news? With the right strategy, you can move into the “good credit” zone faster than you think. This guide breaks down what a 618 score really means, what you still qualify for, and the smart steps you can take to boost your score and unlock better financial opportunities.

A 618 credit score feels like you’re in credit purgatory—not a bad score, but not a good credit score either. You’re not being denied everything, but you might be getting higher interest rates, smaller approvals or extra hoops to jump through.

The good news? This isn’t the end of the road. A 618 score is a starting line, not a finish. With a few smart moves and consistency, you can build momentum, boost your score and start opening doors to better financial options.

In this guide we’ll break down what a 618 credit score means, what you can still qualify for and how to make progress towards better credit.

What Does a 618 Credit Score Mean?

A 618 credit score is in the fair range. It tells lenders that you’re not a high risk borrower but there are a few red flags in your credit history—maybe a late or missed payment or two, a high balance or a short credit history.

Yes, a 618 credit score isn’t perfect—but it doesn’t shut you out either. You’re still in the game with access to many financial products. We call this a transitional score—not where you want to be but full of potential to grow.

Right now the average credit score in the US is about 718 so you’re 100 points behind that. But that gap isn’t permanent. Closing the gap between your credit score and the average credit score can get you better rates, easier approvals and more financial flexibility overall.

What Can You Get with a 618 Credit Score?

With a 618 you have limited credit account options but not none. You can still qualify for certain loans and credit cards—especially if you have a strong income, steady employment or can put money down.

You’ll qualify for secured credit cards which are like training wheels. You put down a refundable deposit, use the card responsibly and the activity gets reported to all three credit bureaus—helping you build credit over time. Some credit card companies also offer unsecured credit cards for fair credit but keep in mind they usually come with higher rates and lower credit limits.

Auto and personal loans are still an option too. The rates might be higher than someone with excellent credit but you can often improve your odds (and terms) with other factors too.

Most conventional mortgage lenders require a credit score of 620 or higher—but you’re almost there. And if you’re open to an FHA loan you can qualify with a credit score as low as 580 and 3.5% down. So yes, even with a 618 you can still buy a home.

Credit Scores

If you’re going for a good credit score it really helps to know how these numbers are calculated and what affects them. Think of your credit score as a three-digit numbered snapshot of your overall credit behavior—how well you handle borrowing and paying back money.

What’s in Your Credit Score?

When lenders calculate your credit score they look at five main things from your credit report:

- Payment history is the biggest factor. One missed payment on your credit report can hurt your credit score.

- Credit utilization rate is how much of your available balance you’re using on your credit card accounts. Using too much available credit even if you pay on time can lower your credit score.

- Length of credit history counts too. Lenders like to see you’ve been managing multiple credit accounts for a while so they look at your average age of credit.

- New credit inquiries when you apply for new credit, it can cause small temporary drops especially if you’ve applied for several things in a short period.

- Credit mix is about the different types of credit you have, like credit cards (revolving credit) and loans (installment loans). A good mix shows you can handle different types of debt responsibly.

Credit Scoring Models and What the Numbers Mean

There are two main credit scoring models that lenders use: FICO® and VantageScore®. Most lenders use FICO scores but you might see your VantageScore when you check your credit for free online. Both range from 300 to 850 but they calculate credit scores slightly differently.

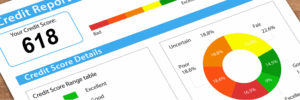

Here’s a quick breakdown of typical credit score ranges to help you understand where you stand:

- 300–579: Poor

- 580–669: Fair (that’s where your 618 falls)* 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

At 618 you’re close to getting into the good credit score range—a very achievable goal with the right habits. And remember, since different credit scoring models weight things differently it’s normal to see multiple credit scores floating around.

How to Improve a 618 Credit Score

Having a good credit score isn’t about doing one big thing—it’s about building healthy credit habits that show lenders you’re financially responsible.

Review your credit reports regularly and you’ll see where you need to improve. You can get your own credit report for free once a year through www.annualcreditreport.com.

What’s Causing a 618 Credit Score?

Every credit score tells a story about your credit report. For some it’s high credit card balances or maxed-out cards. For others it’s a missed payment from a year ago that’s still dragging their credit score down. Some people just don’t have enough credit accounts or credit history built up to score higher.

Other common culprits are collections accounts, charge-offs, or too many hard inquiries on your credit report. Knowing what’s pulling your credit score down is the first step in knowing where to focus your efforts.

Smart Action Steps to Boost Your Credit Score

Good credit scores don’t happen overnight and everyone’s timeline is a bit different. But with steady effort most people can raise their score from the low 600s to around 700 in 6 to 12 months. The best way to get started is by focusing on the basics:

- Always pay your bills on time. Even one late payment can hurt your credit score but paying bills consistently on-time can build your credit score month after month. Use automatic payments to ensure all your payments are paid on-time.

- Reduce your credit utilization. If you can, pay down existing credit card account balances to keep credit usage below 30%—or even better, under 10%.

- Avoid applying for new credit unless necessary. Too many new credit applications can look risky to lenders and hurt your credit score temporarily.

- Keep older accounts open. Unless they come with expensive annual fees your oldest open accounts are helping you.* Dispute inaccuracies on your credit report. A single error, like a misreported late payment or duplicate account, can be damaging—but also fixable. Make sure to check your credit report with all three credit bureaus.

Tools That Can Help You Build Faster

Some people find success with credit-builder loans or secured credit cards, while others benefit from platforms that report rent and utilities to the credit bureaus.

You can also become an authorized user on someone else’s credit card to boost your creditscore using their positive payment history.

Final Thoughts: A 618 Credit Score Is Just the Beginning

While a 618 credit score might not get you the best rates or most attractive offers, it’s far from a dead end. The best part? Progress doesn’t have to take years. By focusing on consistency—paying bills on time, lowering your credit card balances, and monitoring your report—you can start seeing results in just a few months.

When you’re ready to take charge of your credit, Dovly is here to make things simpler. It’s a smart, automated tool that helps you track, manage, and improve your credit score—so you don’t have to wonder what to do next.

Frequently Asked Questions

Is a 618 credit score ok?

Can I buy a house with a credit score of 618?

Can I get a car loan with a 618 credit score?

How long does it take to get a 700 credit score from 600?