687 Credit Score: What It Means and How to Make It Even Better

A 687 credit score is considered good, but there’s still room for improvement. With this score, you can likely qualify for credit cards, auto loans, and even mortgages, although you may face slightly higher interest rates than those with very good or excellent credit. This guide breaks down what a 687 score means, what types of loans you can get, common credit mistakes to avoid, and specific tips to boost your score—like paying down debt, keeping accounts open, and maintaining on-time payments. With smart habits and the right tools, like Dovly, you can raise your score and unlock better financial opportunities.

You’ve checked your credit score and it says 687. Not bad, right? But is that number really “good”? Can you get approved for the personal loan or car that you’ve been eyeing? Or is it time to level up your credit game?

Truth is, a 687 credit score puts you in a decent spot—but there’s still room for improvement. With just a few strategic moves, you could boost your credit score and unlock better rates, higher approvals, and more financial freedom.

Let’s break down exactly what a 687 credit score means, what you can qualify for, and how to push that number even higher. Your financial goals are within reach!

What Does a 687 Credit Score Really Mean?

Let’s get this out of the way: a 687 credit score is not bad. In fact, it’s generally considered to be in the good range according to most credit scoring models, including FICO and VantageScore. That means lenders generally see you as a responsible borrower who’s likely to repay debts on time.

Credit scores between 670 and 739 are labeled as a good credit score, and you’re just shy of crossing into the very good category. So while you may not qualify for the absolute best interest rates or premium credit cards just yet, you’re far from being in risky territory.

Lending Options with a 687 Credit Score

Compared to the national average for credit scores—currently around 715 to 720—your credit score is slightly below the middle of the pack. That doesn’t mean you’re missing out though, but it does suggest you might face higher interest rates or offer smaller loan amounts than someone with a higher credit score. Let’s look at your borrowing options:

Credit Cards

You’ll likely get approved for credit cards. However, your interest rate could be higher than average—something like 18% to 24%—and your initial credit limit might be modest. But consistent use and on-time payments can unlock credit limit increases quickly.

Auto Loans

Car shopping with a 687 credit score? Good news—you’re in the “prime” lending category. That means you’re likely to qualify for traditional loans with competitive loan terms.

However, your interest rate might still be slightly higher than someone with a credit score above 740. For example, you might be offered 5% instead of 3.5%. But remember, those with lower scores do face even higher interest rates!

Home Loans

A 687 credit score is usually enough to qualify for a conventional mortgage loan—especially if your income is solid and your debt is low. You’ll probably want to shop around different lenders, though, because rates can vary depending on different lenders. If you’re a first-time homebuyer, FHA loans or VA loans may offer more favorable terms and won’t require large down payments.

Personal Loans

Looking for a personal loan to consolidate debt or fund a big expense? You’re in luck—most lenders will consider borrowers with a 687 credit score worthy of personal loan approval.

Expect a moderate interest rate on personal loans—higher than the best advertised personal loan rates, but far from predatory. Credit unions and online lenders often offer borrowers more flexible options than big banks.

Understanding Credit Scores

Credit scores are actually based on information gathered directly from your credit report. If you’re sitting at a 687 credit score, understanding credit scores in general is your first step toward improving it.

Key Factors That Affect Your Credit Score

Each piece of your credit report plays a role—some more than others. There are several factors that make up your credit score.

Payment History (35%)

Payment history is the single most important factor of your credit score. Lenders want to know that you’ll pay them back on time. Even one late payment on your credit report—especially one that’s more than 30 days overdue—can cause a noticeable drop in your credit score.

Credit Utilization Ratio (30%)

This refers to how much of your available credit you’re using. Ideally, you want to stay under 30%—and under 10% is even better. So, if you have a $10,000 credit limit, keeping your balance below $3,000 is key. A high credit utilization rate signals that you might be overextended, which makes lenders nervous.

Length of Credit History (15%)

The longer your credit accounts have been open, the more stable you appear. Oftentimes, this is presented in a “average length” rather than how long you’ve had credit. If you’re new to credit or have recently closed older accounts, this part of your credit score might be dragging.

Credit Mix (10%)

Lenders like to see that you can handle different types of credit accounts. A good mix includes things like credit cards, auto or personal loans, and mortgages.

New Credit (10%)

Every time you apply for a new loan or credit card, a hard inquiry hits your credit report. One or two is fine, but too many in a short time frame can make you look risky.

Credit Scoring Models & Credit Score Ranges

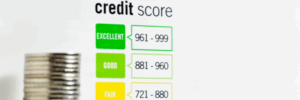

Now that you know what makes up a credit score, let’s dig deeper. Not all credit scores are created equal. The two most commonly used scoring models are FICO and VantageScore. While VantageScore does look at other factors than FICO does, both models generally score in the same range.

- 300–579: Poor – Significant improvement needed to access most credit products.

- 580–669: Fair – You may have access to some credit accounts, but face high interest rates and less favorable terms.

- 670–739: Good – This is where a 687 score falls. You’re in good standing with lenders and have access to better financial opportunities with lower interest rates.

- 740–799: Very Good – Strong credit that unlocks lower loan rates and better rewards.

- 800–850: Excellent – You’ll likely qualify for the best rates and highest credit limits.

Common Mistakes to Avoid

With a credit score in the good range, the last thing you want is to go backward. Even one wrong step can undo months of progress. Watch out for these common pitfalls:

Late or Missed Payments

Just one late payment on your credit report can cause your credit score to drop by 50–100 points—especially if you’ve never missed one before. If you’re struggling to remember due dates, set up automatic payments or alerts.

High Credit Card Balances

Using too much of your credit limit sends the message that you’re overextended. Even if you pay your card off in full each month, the balance reported to the credit bureaus could hurt your credit score if it’s high when they check.

Closing Old Accounts

Think twice before closing that credit card you opened in college. Older accounts boost your average credit age, which is good for your credit score. If you’re not using a card, consider keeping it open with a small recurring charge just to maintain activity.

Applying for Too Much Credit at Once

Each new credit application creates a hard inquiry. Too many of these in a short period—especially if you’re denied—can signal risk to lenders and drag your credit score down.

How to Improve Your 687 Credit Score

It feels good to have a good credit score, huh? Imagine what even higher credit scores feel like though! Here’s how you can reach new heights:

Small Fixes with Big Credit Impact

Pay Down Existing Debts

High credit card balances hurt your credit utilization ratio. If you’ve got the money to bring those balances down, it can give your credit score a quick and significant lift. You also may be able to ask for an increased credit limit which will also lower your credit utilization ratio.

Dispute Errors on Your Credit Report

From incorrect balances to accounts that don’t belong to you, credit report errors are more common than you’d think. Check your credit reports for any suspicious activity or incorrect report, and dispute any inaccuracies—especially ones dragging your credit score down. You can get a free credit report from each credit bureau every year at www.annualcreditreport.com. Dovly also offers a free credit score and report from TransUnion.

Become an Authorized User

If a family member has excellent credit, ask if they’ll add you as an authorized user to their card. Their good credit behavior can positively influence your credit score—without you needing to use the card at all or even the financial responsibility of their debts.

Long-Term Good Credit Habits That Work

Always Pay on Time

Set it and forget it! Your payment history really does matter. Use autopay for minimum payments to avoid late fees, and make extra payments manually if you can. Timely payments are the foundation of great credit.

Keep Old Accounts Open

It’s usually best to keep accounts open—even if you rarely use them. Old accounts strengthen your credit history and help with credit utilization.

Diversify Your Credit Mix

If you only have credit cards, consider an installment loan like a personal loan. If you have only auto or personal loans, a credit card can round things out. A diverse credit portfolio shows you can manage different types of debt responsibly.

How Long Does It Take to Improve Your Credit?

Good news: credit score improvements can happen faster than you think. Paying down balances can raise your credit score in a month or two, removing errors may boost your credit score within 30–60 days and establishing long-term credit habits pays off over 6–12 months or more.

You won’t jump from a 687 credit score to a 800 credit score overnight—but with smart choices, you could break 700 in a few months and keep climbing from there.

Conclusion

A 687 credit score is a solid start for financial health—but it doesn’t have to be your finish line. With the right tools, a few steps and a little determination, you can turn your good credit score into a very good credit score and unlock even more financial opportunities.

Why wait? Enroll in Dovly today! Our Free plan offers a free credit score and one dispute each month, while Premium offers more. Plus, we have a marketplace of referral partners that offer personal loans, credit cards or even extra money!

Frequently Asked Questions

How rare is a 700 credit score?

Can I buy a house with a 687 credit score?

Can I buy a car with a 687 credit score?

How to get an 800 credit score?