A better financial future for your members

Less stress — especially financial stress — means happier members. Dovly’s automated credit engine helps your members get ahead financially by tracking, managing, and fixing their credit.

Provide Dovly as a member benefit to foster engagement, increase retention, and promote financial inclusion. As members move up the credit hierarchy, they’ll gain access to products and services previously denied to them. This will reduce their overall financial hardship, and the stress that goes with it.

Contact our team to get started today!

With a 91% success rate, we disputed 500,000+ credit errors.

On average, Dovly members see the following results:

56

point average

credit score ↑

58

point median

credit score ↑

3.6

credit report

errors removed

You make it easy for your employees.

We make it easy for you.

Integrate and auto enroll

Track Dovly’s impact

Generate impact reports, so you can see how your members are benefiting individually and as a whole.

Privacy and protection

Secure with data encryption at rest (AES-256) and transit (TLS), field-level encryption of sensitive data, and strict data retention policies as well as access controls.

Engage your members

Send automated credit notifications to members through Dovly. By celebrating their progress, you’ll reinforce satisfaction and loyalty.

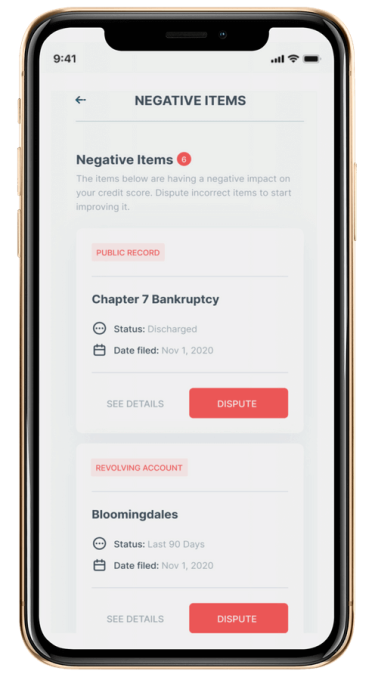

Here’s how it works

Everything credit. All in one place.

Since 2018, Dovly has been helping its members get ahead financially — but credit improvement is just one part of it.

Throughout the year, your employees will improve their financial literacy with:

• Personalized alerts and recommendations

• Tips to avoid credit landmines, reporting errors, and identity theft

• Newsletters and blog posts featuring actionable advice

• Best practices and links to helpful resources from credit experts

Pricing Dovly

Credit unions looking to implement Dovly as a member benefit will be provided with custom pricing to fit their needs.

Questions? Email sales@dovly.com.